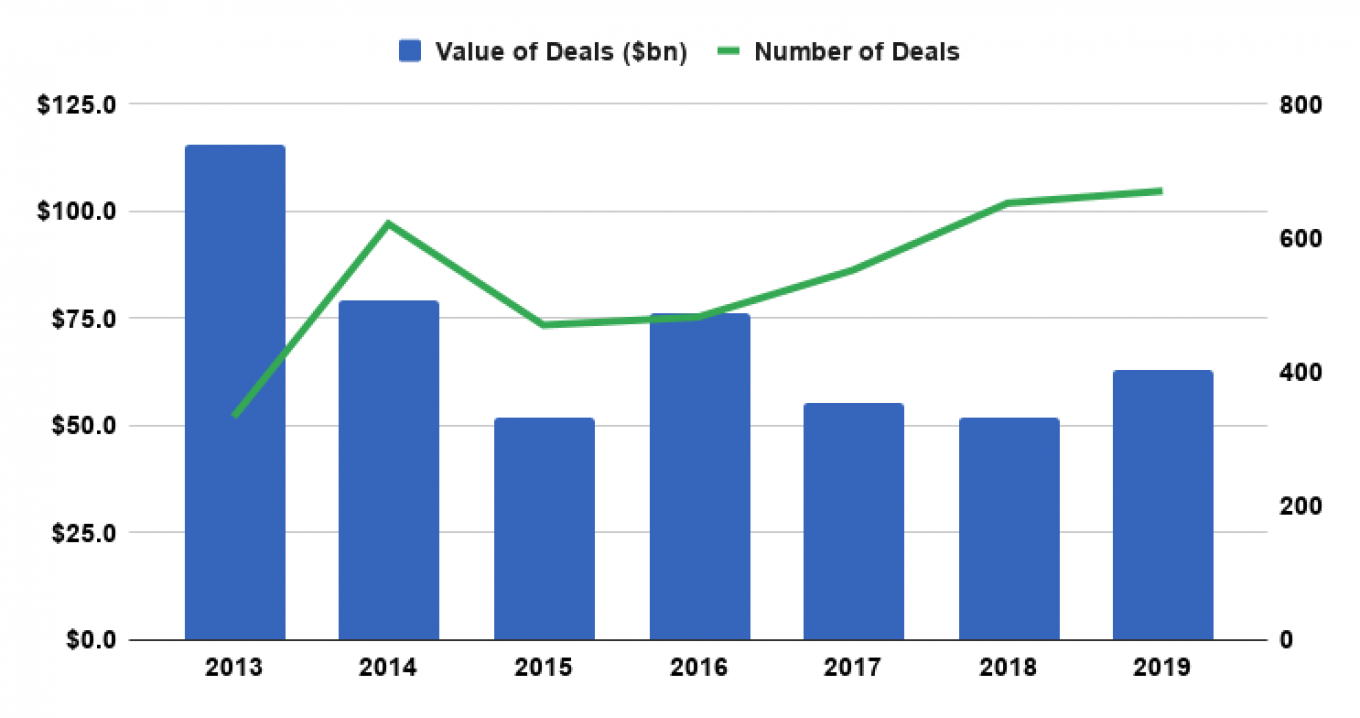

Russian businesses were involved in more mergers and acquisitions (M&A) in 2019 than in any year since the introduction of sanctions, a new report from audit and consulting giant KPMG has found.

The total value of M&A involving Rusian firms climbed by a fifth last year to $63 billion, based on 670 individual deals across the Russian corporate world, the report said.

“Last year was the most successful in terms of investment activity since the introduction of sanctions,” said KPMG’s head of deal advisory Lydia Petrashova.

“There was an increase in the number of transactions, an increase in the average transaction amount, as well as the volume of foreign investment, not only from the East — with which Russia has maintained the closest relations in the investment sphere in recent years — but also from Western countries.”

While the number of deals reached a record high in the sanctions era, the value of transactions was still below levels recorded in 2014 and 2016. Compared with 2013, the last full year before sanctions were introduced, annual M&A was down by 45%.

Around two-thirds of reported M&A activity was “internal” — involving only Russian companies and investors — with one-third coming from tie-ups and investments between Russian and foreign businesses.

Deals in the oil and gas sector led the mini-rebound, KPMG data showed, coming it at $21.7 billion for the year, followed by the innovation and technology sphere which was involved in M&A worth $7.5 billion.

The figures were pushed higher by a $3 billion share buyback scheme launched by Lukoil, and two secret auctions of Gazprom shares for a total of more than $5 billion. Other top deals involved Novatek’s Arctic LNG 2 — which secured $7.3 billion in three separate transactions from Chinese and Japanese investors — and tech transactions at telecoms providers Megafon and Tele2 as well as the high-profile tie-up between Sberbank and Mail.Ru for their food delivery and ride hailing joint venture.

KPMG predicts the pick-up will continue into 2020 — highlighting the construction, real estate and consumer industries as primed for potential dealmaking.

“The government’s economic priorities are changing,” the report said.

“It is abandoning its strict financial policy and switching towards increasing spending in the social sphere, which in turn, should stimulate growth in domestic demand, consumption and investment.”

The consultants also noted the fading risk of new U.S. sanctions as a factor which could boost investment this year, but highlighted the potential Defending American Security from Kremlin Aggression Act (DASKA), which has not yet been passed by the U.S. Congress, as one area of uncertainty.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.