(Bloomberg) — Vladimir Putin plans to lay out his vision for his fourth presidential term in a major speech next month, offering Russians the biggest increase in domestic spending in years.

But what he won’t be talking much about is the package of tax hikes, benefit cuts and other changes that are in the works to help pay for the largesse.

The moves include possible increases to the pension age and the income tax, as well as cuts in tax breaks for staples like food, according to three people familiar with the planning.

Among the proposals is the introduction of co-pays for health care, something that’s currently unheard of in Russia’s state-run system, two of the people said.

“The challenge for the next term is to set in motion the mechanisms of restructuring the economy, shifting its structure toward sectors that develop human capital,” said Yaroslav Kuzminov, dean of the Higher School of Economics, who’s involved in the discussions as an adviser.

Without the increases in taxes and cuts to benefits, “I don’t know where the government will get the money,” he added.

Sputtering recovery

For most of last year, Putin had been reluctant to commit to an economic program for his next term, which is likely to be his last.

But as the recovery has shown signs of stalling in recent months and discontent with stagnant living standards has emerged as a key election issue, the Kremlin has accelerated work on measures once considered too politically sensitive to risk, according to people involved in the process.

All but Kuzminov spoke on condition of anonymity to discuss internal deliberations.

Many of the steps were outlined in a reform program put together by former Finance Minister Alexei Kudrin, who Putin appointed in 2016 to lead an advisory panel on economic policy through 2024, when the next six-year presidential term ends.

Kudrin, revered by investors for his prudent fiscal stewardship in Putin’s first two terms, has in recent months taken a less active role in finalizing the plans, which are now being led by Kremlin chief of staff Anton Vaino, according to people involved in the process.

With tight control over the media and political opposition regulated, the Kremlin is confident that it can keep discussion of the unpopular steps from undermining support for Putin. Polls show he’s likely to win overwhelmingly, but the Kremlin is facing a challenge to ensure turnout is high enough to provide the mandate he’s seeking for his new term.

Polls on some of the painful measures under consideration, such as a higher income tax, found voters are willing to support them if they see the money is going to “socially valuable projects,” Kuzminov said.

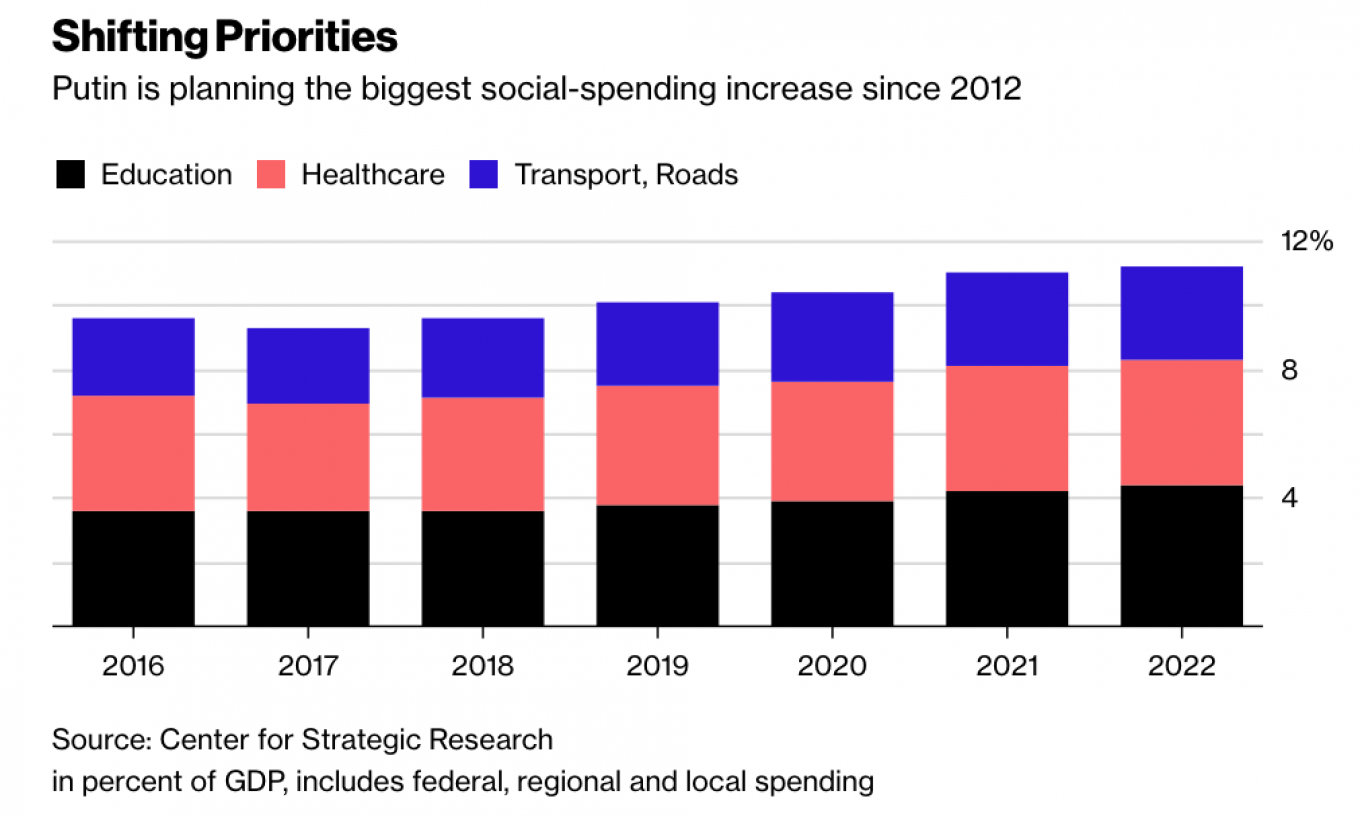

Publicly, Putin is expected to focus on the added spending — as much as 30 percent increases in outlays for health, education and infrastructure, or about 2 trillion rubles ($35 billion) over six years — the largest increases since he last ran for president in 2012.

He’s likely to announce some details in a state-of-the-nation speech set for Feb. 6.

‘Stagnation’ risk

Russia spends far less on hospitals, schools and roads than other industrial countries. In his letter to Putin pitching the plan last year, Kudrin said failing to raise outlays risked “stagnation,” according to a copy seen by Bloomberg.

Putin endorsed the plan in November with a handwritten “agree” on the document. The central bank also backs the plan, provided it’s linked to a detailed program of reforms to stimulate growth, one person said.

The Finance Ministry declined to comment on budget preparations, saying they haven’t officially begun.

In order to prevent the added spending from bloating the deficit — a sensitive issue at a time when the U.S. is looking at possible sanctions on Russia’s sovereign debt as a way to punish the Kremlin for alleged meddling in the 2016 elections — the plan calls for raising new revenue and cutting other spending.

Last year, the federal budget ran a deficit of 1.4 percent of gross domestic product, narrower than initially forecast.

An increase in the income tax, either by raising the current flat rate of 13 percent or shifting to a progressive system, is likely to be among the first moves discussed publicly after the vote, according to the people involved in the discussions.

Steps to raise the pension age, now 60 for men and 55 for women, and sharply reduce early-retirement benefits, are also expected to come soon.

Other changes could include elimination of value-added-tax breaks for food and medicine and possibly a new sales tax, as well as higher levies on luxury goods.

The Health Ministry has been pushing for a tripling of excise taxes on tobacco to bring them to European levels by around 2022, which would have the double benefit of raising revenue and reducing health-care costs for smoking-related illnesses.

The Kremlin backs increases but hasn’t agreed to specific targets yet, according to one person.

Officials have also discussed the possibility of introducing co-payments for state-provided health care and education, which are now officially free of charge, but people close to the discussions said that move could be too politically explosive to win approval.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.