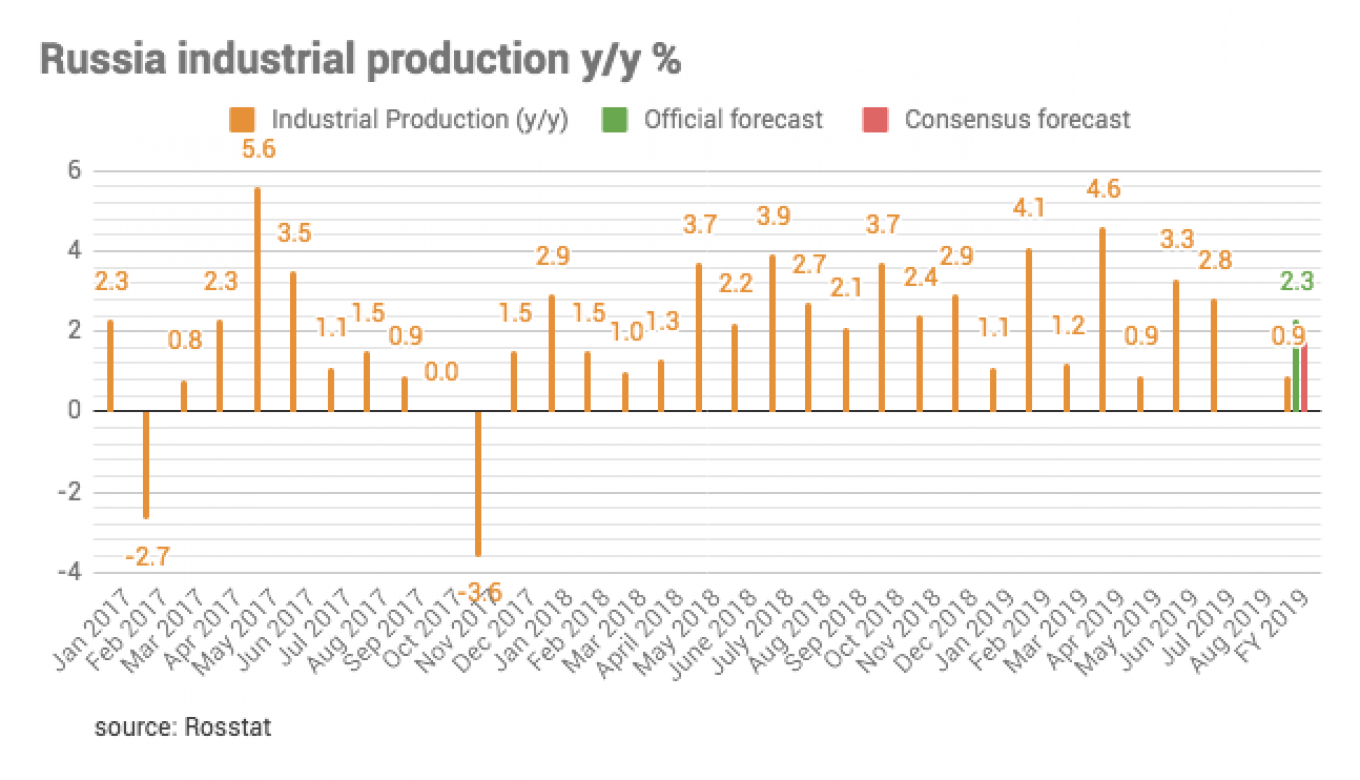

Russian industrial output growth slowed down to 2.8% year-on-year from 3.3% seen in June, trending below the consensus expectations of 3.4% growth, and showing a seasonally-adjusted month-on-month decline of 0.4%. In January-July overall industry expanded by 2.6% year-on-year.

Industry has been showing uneven and disappointing dynamics in the beginning of 2019, but is generally expected to pick up on rising state infrastructure spending on national projects.

In July output in the resource industry was up 3% year-on-year (2.3% in June), while the manufacturing sector expanded by 2.8% year-on-year (3.4% in June), and utilities by 1.7% (2.5% in June).

Sberbank CIB on Aug. 16 commented that it expects "rising government infrastructure spending in the second half of 2019 to support manufacturing (particularly construction materials and equipment) and industrial production as a whole."

However, headwinds such as generally weak external demand (particularly for metals), due to the uncertain global trade picture, is limiting the potential for growth, Sberbank argues and forecasts the industrial production to increase by 2.5-3.0% in 2019.

Vladimir Tikhomirov of BCS Global Markets believes that the second half of 2019 expected rebound may end up being less pronounced as "consumers remain under pressure and the state continues to take a slow approach to investments in national projects," seeing July's industry data as negative.

"Production dynamics in various industry segments show fairly robust output in mining, oil and gas and food-processing, a mixed picture in chemicals and the automotive sector, small declines in construction materials’ industry and contraction in many areas of consumer goods’ production," BCS GM notes.

BCS GM analysts believe that industrial date shows continued stagnation in the economy and finds it premature to expect significant improvements in the second half of 2019, given suppressed consumer demand, low investment activity, and "ultra-stringent" fiscal policy. BCS retains the 2019 GDP forecast at 1.1% year-on-year, and warns of rising downside risks.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.