The Central Bank of Russia (CBR) is worried about a growing housing bubble and will act to cool the mortgage market, but market participants think the regulator is being overly cautious.

The CBR published a warning to banks saying that the growing number of loans could be causing real estate prices to rise, which causes a feedback loop that will send prices up and encourage borrowing.

Consumer debt has been ballooning in general in the last two years as Russians turn to bank loans to maintain their lifestyle in the face of stagnant real income growth. More worryingly, punters are also taking loans to refinance their old debt.

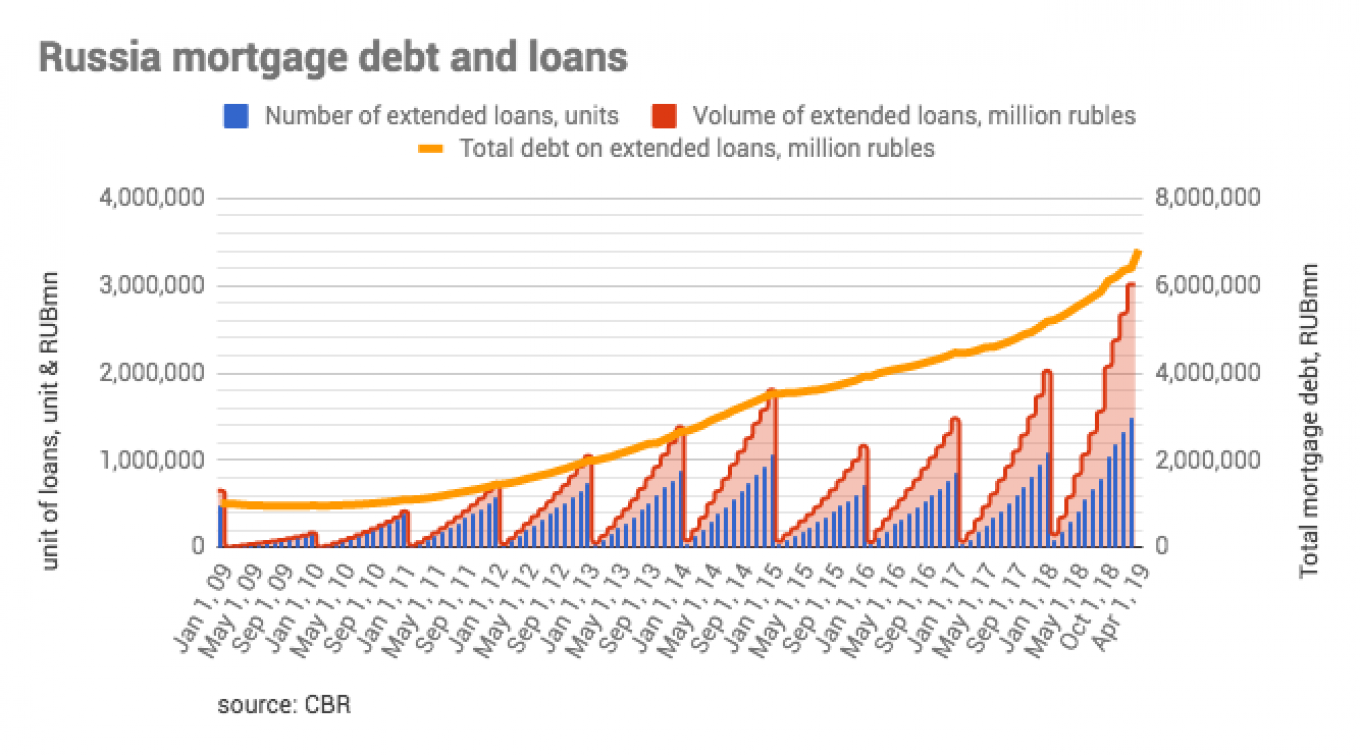

Within the consumer borrowing, business mortgage lending has been booming and is one of the more profitable business lines for banks. As bne IntelliNews has reported, Russia’s real estate market is coming back to life and the residential sector is increasingly driven by mortgage loans, which have risen from nothing to about two-thirds for funding purchases.

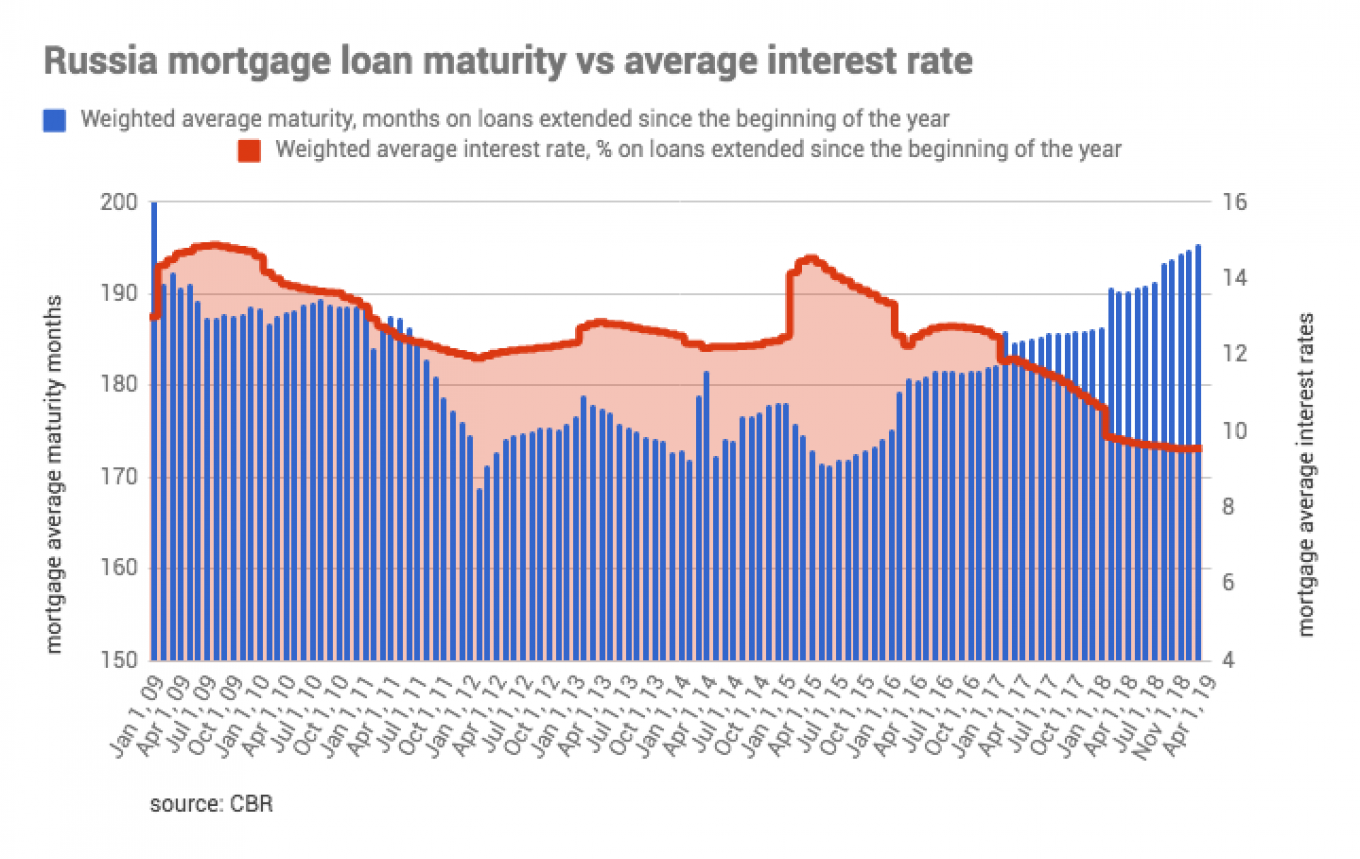

The Kremlin has been actively encouraging the growth of mortgage lending. Until last year the government was subsidising mortgages while the average rate on a loan was over 12 percent, but after the average fell below that rate the subsidies stopped. Earlier this year average rates on home loans dropped below 10 percent and in March President Vladimir Putin called on banks to bring rates to below 8 percent.

The CBR has once again bolstered its credentials as one of the most conservative and orthodox in the world and is actively trying to cool all this consumer lending activity, although analysts quoted by Vedomosti said the regulator may be over cautious.

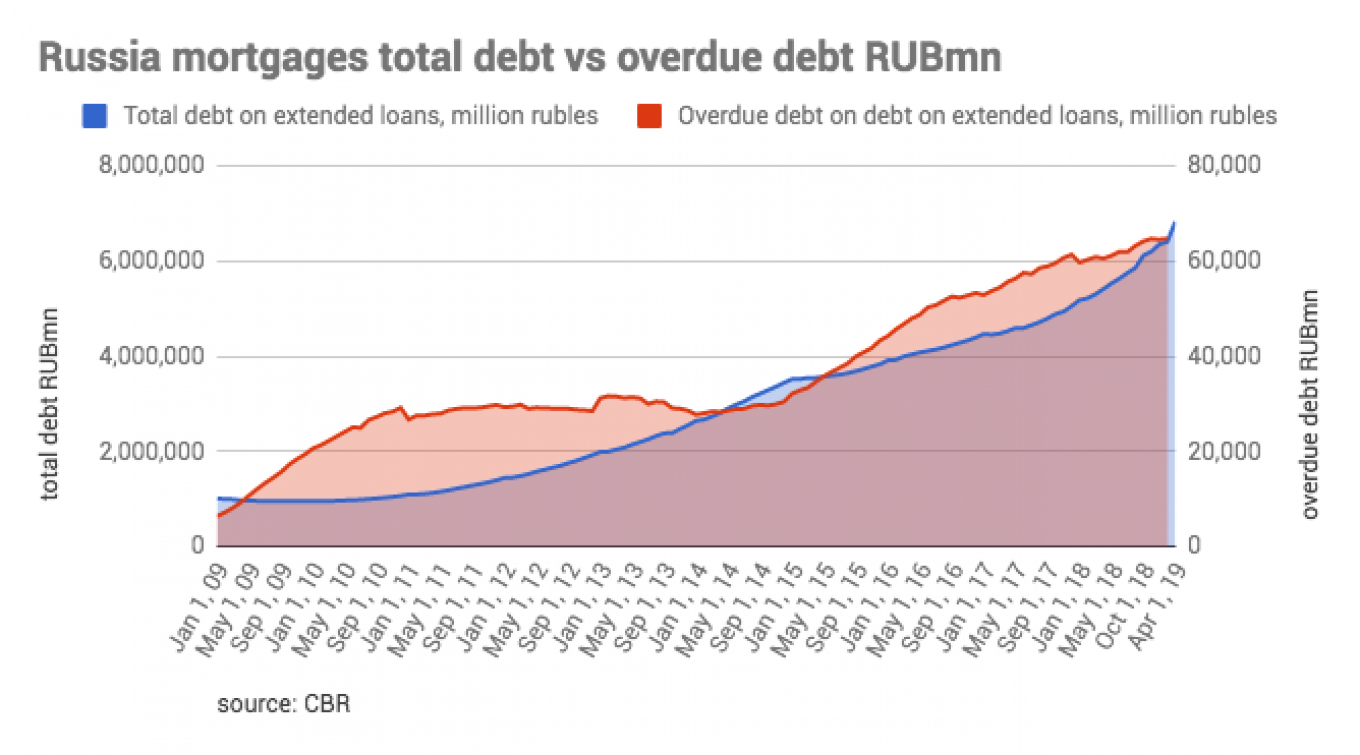

The amount of overdue mortgage loans has remained consistently around 2.1 percent of total loans extended, despite the rapid growth in the volume of loans issued, as well as the increase in the average size of the loans. The average loan size has been increasing by 100,000 rubles every year for the last five years to the current 2million rubles ($27,365).

At the same time, the value of non-performing loans (NPLs) in the banking sector is at 1.1 percent, BMB reported in a note.

“Real estate prices may have risen in the last six months, but over the last seven years prices on the secondary market have fallen by 30 percent — hardly the makings of a bubble. That the CBR is so closely watching these developments is itself an indication that next big crash will probably come from somewhere else,” BMB said.

During the period from October 2018-April 2019, mortgage debt rose by 24.7 percent. Russians currently have 6.82 trillion rubles in mortgage debt. The CBR is most concerned about mortgages with down payments of under 20 percent. From the beginning of this year, the central bank increased reserve requirements for these loans.

In 2018, real estate prices rose by 8.7 percent on the primary market and 4.9 percent on the secondary market. Some of this increase comes from a ban on pre-selling apartments and the introduction of escrow accounts. Bank analysts do not see signs of speculative behavior that could indicate a bubble, like house flipping or purchases of multiple homes on credit, BMB reported.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.