Russia’s central bank unexpectedly increased borrowing costs for the second time this year and signaled it may soon act again as inflation accelerates amid a tax hike and possible new U.S. sanctions.

“The central bank will consider further key rate increases based on inflation and economic dynamics relative to forecasts, as well as risks posed by external conditions and the reaction of financial markets,” the central bank said in a statement. It also warned oil prices could fall further as supply outstrips demand next year.

The bank raised its key interest rate a quarter-point to 7.75 percent. The majority of the 42 economists surveyed by Bloomberg had predicted a hold, with only 16 forecasting the hike. The ruble declined, as any impact of the tightening was offset by an announcement the central bank will resume billions of dollars in foreign currency purchases from Jan. 15.

Governor Elvira Nabiullina will hold a news conference at 3 p.m. in Moscow.

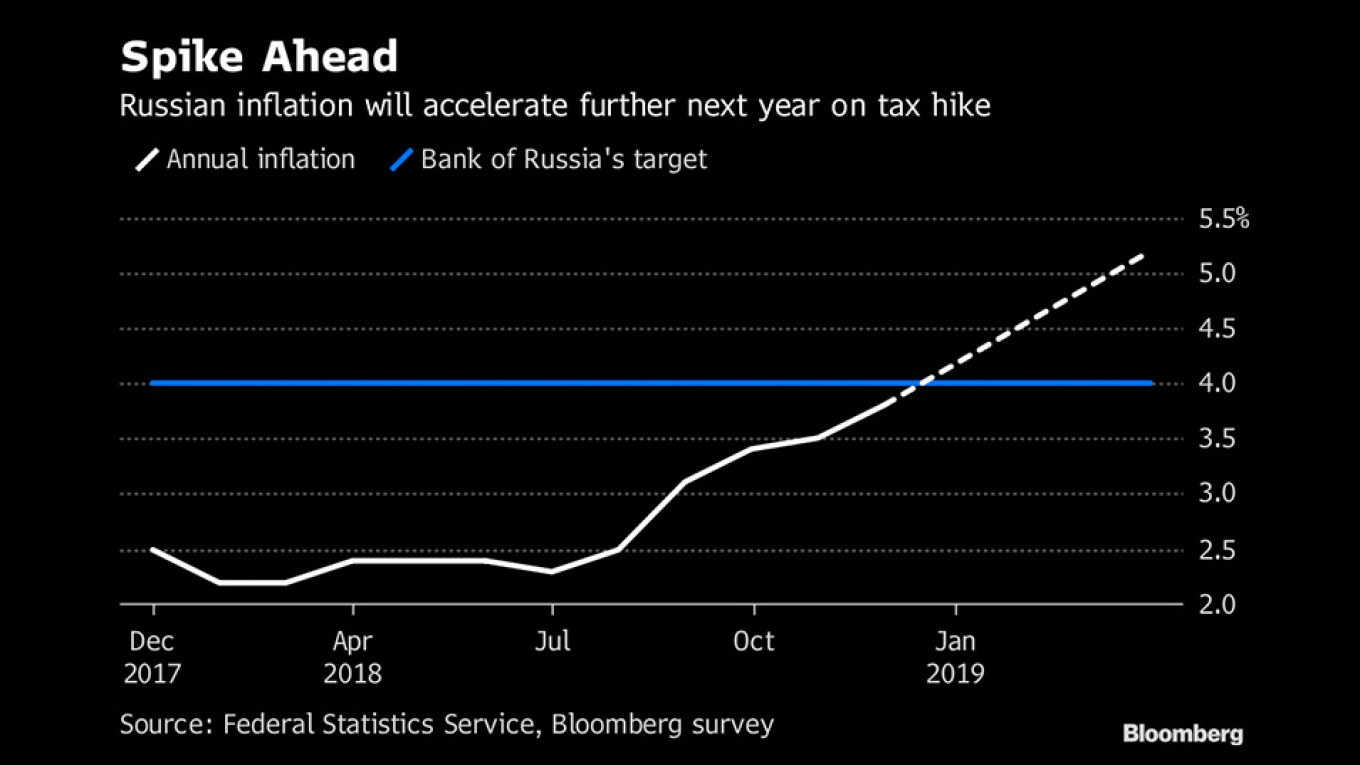

The move will give extra protection to the ruble as it heads into a potentially tumultuous quarter after a more than 13 percent plunge this year. Inflation is edging closer to the central bank’s 4 percent target and could spike next quarter after a value-added tax increase kicks in. Discussion over sanctions for Russia’s alleged interference in U.S. elections is expected to resume again after a delay this year.

“The rate hike is aimed at limiting the possible negative effect on the market from restarting the FX purchases,” said Tatiana Evdokimova, chief economist for Russia at Nordea Bank.“Future moves by the central bank will be highly dependent on how the VAT increase effects inflation expectations.”

Annual inflation accelerated for a sixth month to 3.9 percent as of December 10, the central bank said in today’s statement. It may reach 5.2 percent by the end of March, according to a Bloomberg survey.

The central bank typically buys foreign currency to build up reserves when oil prices are above $40 a barrel. Purchases were suspended in August to stem a slide in the ruble as concern mounted over sanctions. The recent plunge in global oil prices means the central bank will only have to buy about $201 million a day, below the 2018 average, to its meet targets, according to Bloomberg Economics.

The ruble traded 0.4 percent weaker at 66.49 per dollar. The yield on Russia’s 10-year local-currency bonds was unchanged at 8.7 percent.

The resumption of FX purchases “will contain any strengthening of the ruble,” said Vladimir Miklashevsky, a strategist at Danske Bank A/S in Helsinki. “Given the current uncertainty in external factors and the central bank’s conservatism, at least one hike in 2019 is highly likely.”

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.