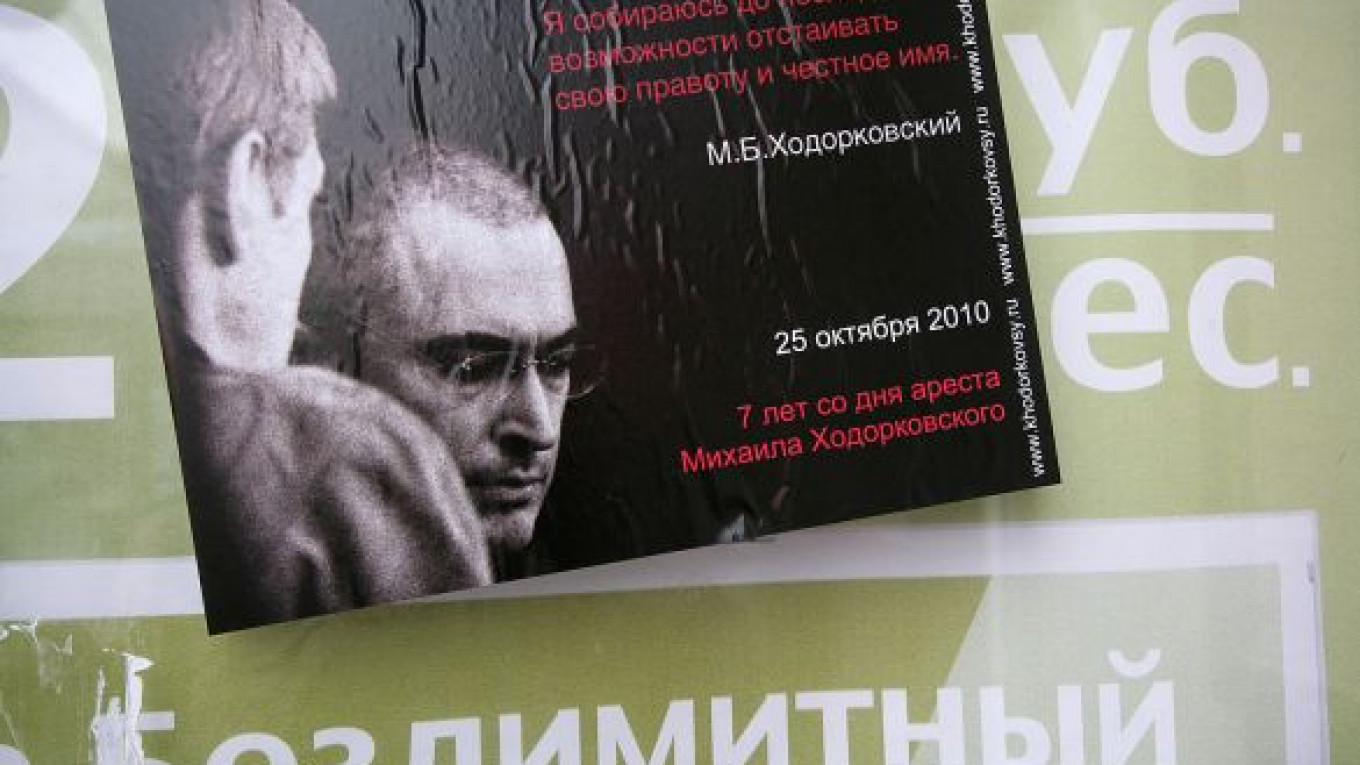

An acquittal at the end of this month for former Yukos head Mikhail Khodorkovsky, jailed on oil-theft charges, would attract new capital to Russia and drive stocks higher, investors said.

The trial ended on Nov. 2 and the judge announced Wednesday that he will begin reading the final verdict on Dec. 27. The process could take several weeks.

“If he were paroled or pardoned, the stock market would be ecstatic, although most investors believe the punishment for his sins will be extended,” John Heisel, a Moscow-based sales trader at Citigroup, said by phone.

“A political pardon for Khodorkovsky would be helpful from a market point of view,” Mattias Westman, chief executive of Prosperity Capital Management, the largest Russia-focused equity investor with $4.5 billion under management, said by phone. “It shouldn’t have much impact on Russia’s investment case, but it’s something investors keep bringing up with us.”

The MICEX Index surged 1.6 percent on Aug. 22, 2008, after a Russian media report, later retracted, that Khodorkovsky had been paroled.

The verdict handed down by Moscow’s Khamovnichesky District Court will be “predictable,” Khodorkovsky said in his closing statement. “No one believes that you can get an acquittal in the Yukos affair in a Moscow court.”

Vadim Klyuvgant, one of Khodorkovsky’s lawyers, said only an acquittal would be in line with Russian law. “There’s no crime,” he said by phone. “It’s not just that specific people are innocent; no crime was committed.”

While prosecutors reduced the amount of oil Khodorkovsky is accused of stealing to about 219 million tons from 350 million, the assessed financial damage to the state hardly changed, said Maxim Bar, a spokesman for the defense team.

Former Prime Minister Mikhail Kasyanov, who testified as a defense witness in the trial, said Khodorkovsky and Lebedev have a “5 percent chance” of acquittal. “It won’t be a just decision; it will be another abuse by the authorities,” he said in a Dec. 13 interview.

The Khodorkovsky case is “one of the irritants that investors traditionally react to,” though it’s no longer a “primary concern,” said German Gref, chief executive of Sberbank.

“We have our work cut out for us to improve the investment climate,” Gref said in a Dec. 13 interview. “This will produce entirely different results from the perspective of influencing investors’ opinions.” The Khodorkovsky case is “one episode, but we have systemic issues that aren’t resolved,” such as defense of property rights and improving the judiciary and law enforcement, he said.

Gref was economy minister when Khodorkovsky was arrested. He testified in the oil-theft trial that his responsibilities as minister didn’t include “inspections” of corporate finances. Still, he said he would have been informed if other officials had uncovered theft by executives at a company as big as Yukos.

Russia’s winning bid to host the 2018 World Cup and officials’ claims that accession to the World Trade Organization is possible in the first half of 2011 helped lift the benchmark MICEX Index 15.7 percent this quarter, beating a 4.9 percent advance for the MSCI Emerging Markets Index.

Yet the MICEX currently trades at 8.9 times earnings, less than the 14.4 price-to-earnings ratio for the MSCI Emerging Markets Index, because investors are wary of the high political and corporate governance risks underlying the stock market.

“Russia is the cheapest among the main emerging markets,” Patrick den Besten, manager of ING Investment Management’s emerging markets fund, which has $2.5 billion under management, said by phone from The Hague. “It is in need of a couple of catalysts to catch up on its peers. Corporate governance and the influence of politics has been a keen issue, and we need to see real change.”

Yukos was bankrupted under $30 billion of tax claims and sold off in pieces, mostly to state oil company Rosneft. Khodorkovsky has said his 2005 conviction was motivated by his opposition to Vladimir Putin, who was president at the time of his 2003 arrest. Putin said Khodorkovsky “deserved his punishment” in an interview with Kommersant in August.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.