The ruble and Russian stock market once again sunk deep into the red Thursday after U.S. President Donald Trump moved to block most travel from Europe to the U.S.

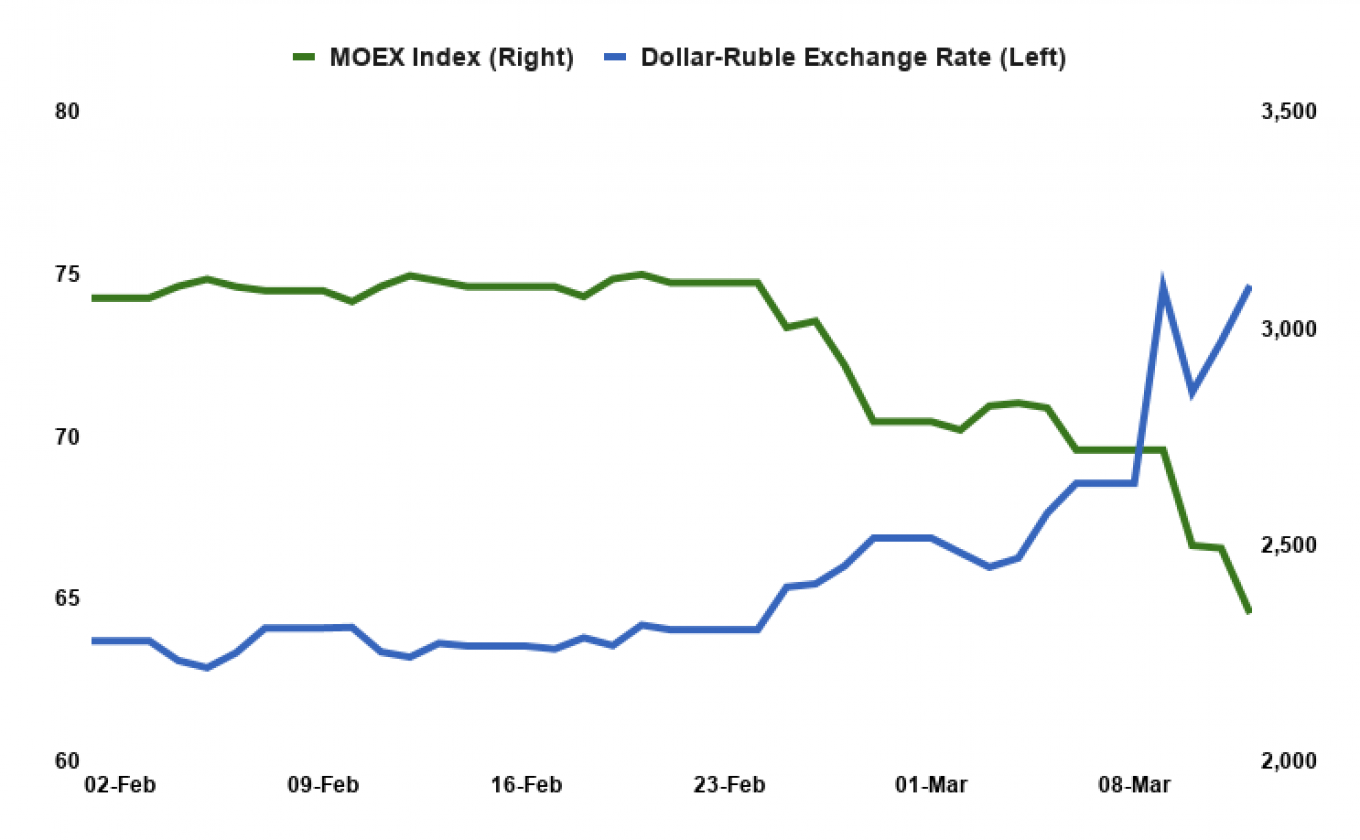

In another bloody day on the world’s financial markets, the ruble lost 4% against the dollar, slipping back toward 75 against the greenback. On the stock markets, the MOEX Index of leading Russian firms fell by almost 6%, while the RTS index, which is denominated in dollars, sunk even more to fall below the landmark 1,000-point level for the first time in more than two years.

Analysts did not hold back on their stark assessments of one of the worst spells for the global economy in a decade.

“Financial market events over the last week or so can be described as epic and a sea-change,” wrote VTB Capital’s Neil MacKinnon in a note to clients.

Markets in Europe and Asia sunk yet again, with many indexes hitting their lowest levels in years.

Russia was once again pushed down not only by global jitters, but a renewed weakening in energy prices. Brent crude oil shed 5% to stand below $34 a barrel, as investors expect weak demand for fuel to continue as countries scramble to slow the spread of the coronavirus.

The outbreak was officially declared a pandemic by the World Health Organization Wednesday evening, and Trump shocked markets and travellers around the world by announcing a near-complete ban on travel from Europe to the United States. He blamed European governments for not doing enough to contain the coronavirus, and said all travel — except for Americans returning home — from the 26-member EU Schengen Zone would be blocked from Friday for 30 days.

“The announcement of a pandemic and the ban on flights from Europe to the United States has increased the flight from risk,” said BCS Premier analyst Sergei Deyneka.

“Events in the oil market that may lead to large-scale overproduction of raw materials due to the OPEC+ rift are an additional trigger for selling in the Russian stock market, with shares in the oil and gas sector securities among the main victims.”

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.