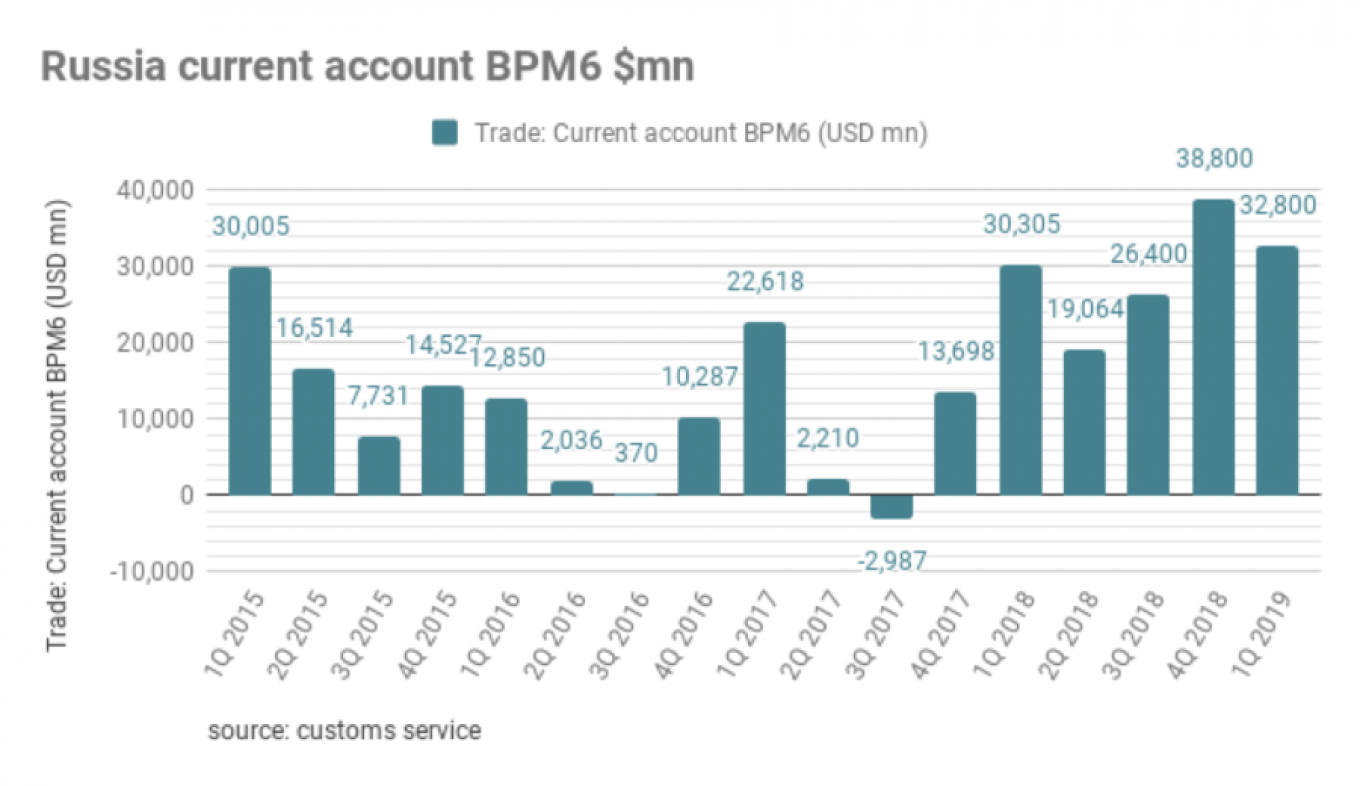

Russia’s current account posted a $45.6 billion surplus in the first half of this year, the Central Bank of Russia (CBR) reported on July 10.

The surplus, according to preliminary estimates, was mainly the result of a large trade surplus ($86.5 billion). The other data shows a significant increase in foreign direct investment ($11.6 billion in the first half of 2019, up by x1.4 year-on-year) and a reversal of capital flows to an inflow of $7.9 billion in June compared with an outflow of $35.2 billion in the first five months of 2019.

Softer crude oil prices offset by weak domestic demand and lower imports all contributed to the surplus. In the first half of 2019, the Urals crude price fell 4.5% year-on-year, which led to a 3.4% year-on-year fall in the trade balance and a 4% year-on-year decline in the current account surplus. However, lower oil prices were offset by weak domestic demand, which drove volumes of imports down by 3% year-on-year.

“Overall, CBR data shows that Russia’s external accounts remain in a solid state,” BSC Global Markets chief economist Vladimir Tikhomirov said in a note. “Russia’s external accounts remain solid, albeit in part a function of weaker demand. The continued current account surplus underscores two key positives – a fiscal surplus and a strong external position.”

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.