Russia’s Finance Ministry is on a tear as it got another no-limits bond auction for its ruble-denominated OFZ treasury bills away, setting a fresh record. In two fixed-coupon OFZ auctions, Russian debt managers collected 124.6 billion rubles ($1.9 billion) in total, Raiffeisen Bank (RZB) said.

“The long-maturity 15-year OFZ attracted almost 40 billion rubles, while the rest was sucked up by the 2024 paper. The favourable external backdrop as well as a certain sanctions “fatigue” combined with recently improved Russian economic fundamentals continue to attract various investor groups to Russian local debt, likely still including foreign investors,” said Stephan Imre, an analyst with RZB, in a research note.

Russia’s Finance Ministry has held a series of record-breaking auctions this year after a dearth last autumn, when the ministry had to cancel several auctions because of the lack of demand.

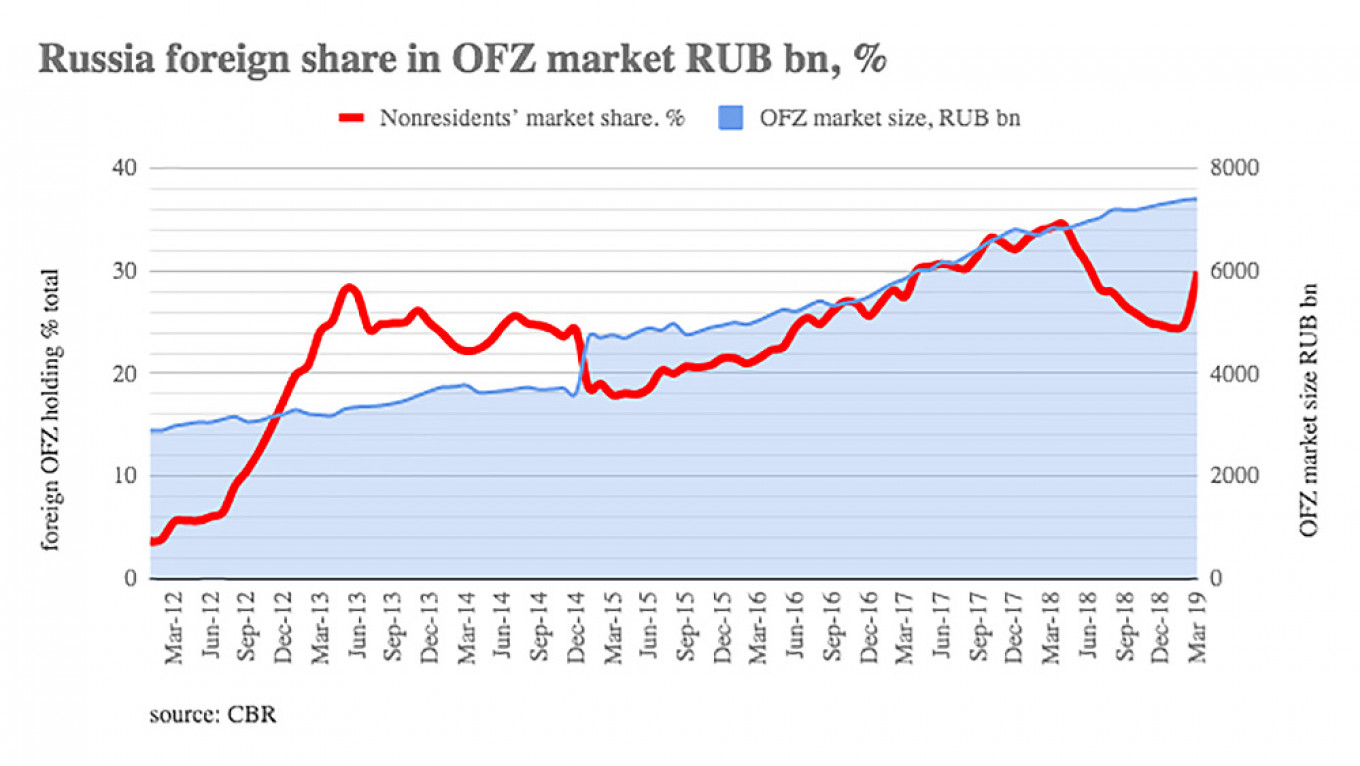

Demand from foreign investors for the OFZ — the Finance Ministry’s workhorse bond — has turned into something of a barometer of foreign investors' sentiment toward the Russian market.

OFZs were hot at the start of last year when most bond investors were overweight, but following the April 6 round of sanctions sentiment cooled and there was a 500 billion ruble sell off; the share of foreign investors in OFZs fell from a record 34 percent in April to finish the year at about 25 percent.

However, since the start of this year the share of foreigners in OFZs has been creeping up again and was back to 30 percent as of the start of April.

Imre said that the share of foreign investors will probably continue to increase in March and April thanks to a number of factors.

Russia’s macro economy is in rude health, with strong tax collection and pre-crisis high gross international reserves (GIR). The economy is back into a triple — trade, currency account and federal budget — surplus, adding to the appeal of its high-yield bonds that pay about 8 percent per year in a world of near-zero interest rates.

Add to this the fading fears of more punitive US sanctions on Russia and the U.S. Federal Reserve's signals that it will not tighten monetary policy more this year.

While the Defending American Security Against Kremlin Aggression Act (DASKAA) sanctions are due to be considered by the US Congress in the first half of this year and could target more Russian companies as well as the sovereign bonds, investors clearly feel the danger of really painful new sanctions is fading.

The most painful of last year’s April sanctions on Russian oligarch Oleg Deripaska and his Rusal aluminium producer have been dropped and in the last week Deripaska said he was in talks with the U.S. Treasury about dropping sanctions on his carmaker GAZ as part of renewed joint venture negotiations with Germany’s Volkswagen.

Finally bond investors were further buoyed by the milder than expected inflation feed from a hike in the VAT rates implemented at the start of this year. While no one expects a rate cut at the next Central Bank of Russia (CBR) meeting due later this month, analysts are speculating that monetary easing may resume in the third quarter.

“Although we continue to expect another US sanctions round, it might be not necessary to respond with another rate hike (still our base case) from a CBR point of view. Our conviction regarding the latter has indeed decreased significantly and we will watch next week’s rate setting meeting closely for a possible revision of our base rate forecasts,” Imre said.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.