The famous cash pile of leading Russian privately owned oil company Surgutneftegaz (Surgut) has grown so big that it is now almost as large as Russia’s sovereign wealth fund.

Surgut reported its Russian Accounted Standards (RAS) results for 2018, under which the company's notorious cash pile increased by 32% in 2018 to 3 trillion rubles ($45bn) — a new record for the company and the most it has had in reserve since 2013.

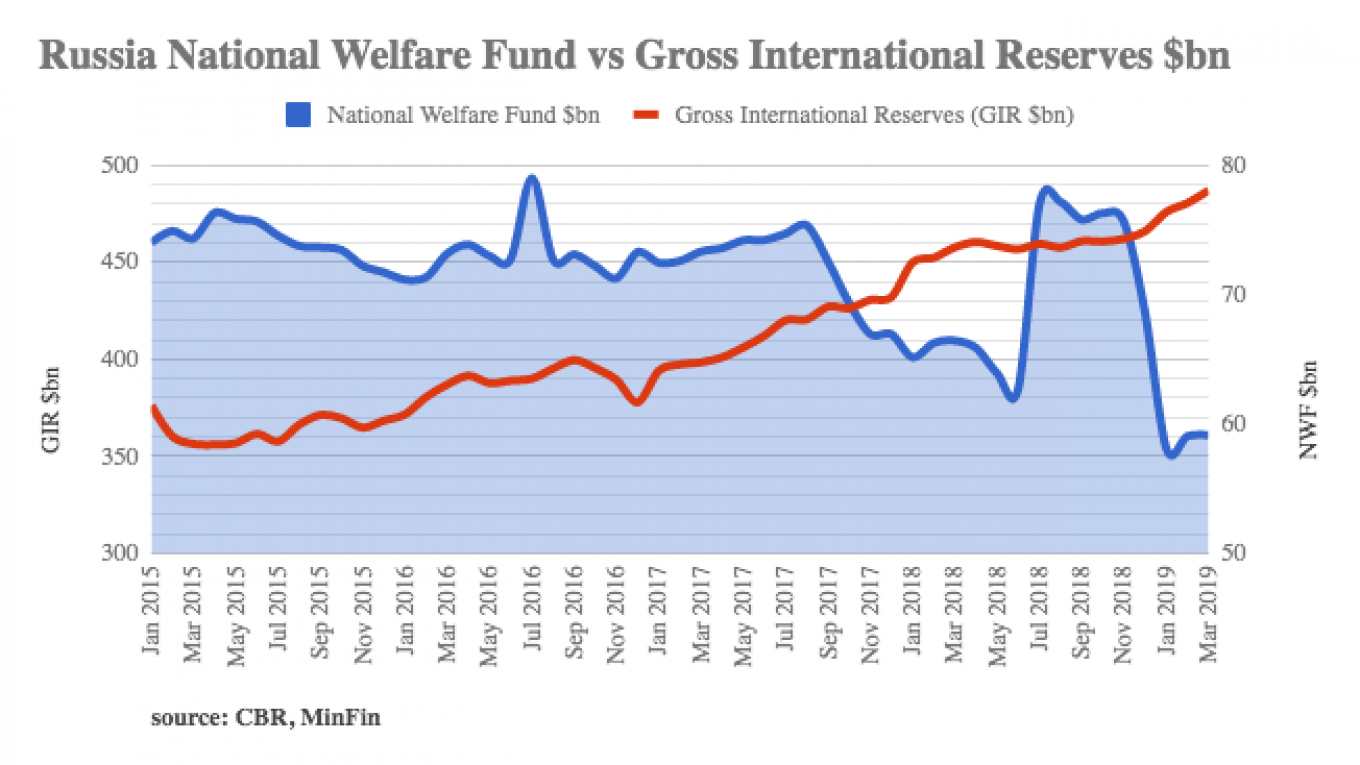

The company’s cash reserves are now only 900 billion rubles less than the entire country's National Welfare Fund (NWF) which stood at 3.9 trillion rubles ($58.5bn) as of March 1 2019.

Russia used to have two sovereign wealth funds, but the reserve fund was spent down and closed by the start of 2018, used to top up the budget. The NWF was originally tasked to meet future pension payments, but has since been re-tasked and become a general use sovereign wealth fund. The level of Russia’s total wealth funds has also fallen during the recent crisis years from around $150 billion at the start of 2015 to its current level of around $60 billion.

Surgut’s huge cash pile has made it an investors’ darling (for the preferred shares), despite the fact that company is notoriously secretive and shares little information with investors. But it does pay out one of the highest dividend yields of the Russian equity market, the bulk of which comes from interest earned on its cash reserve, making the payouts independent of the vagaries of the commodity market prices.

Net profit

In the meantime Surgut gained on the combination of weak ruble and high oil prices and also posted 885 billion rubles in net profit for 2018. Surgut could pay 10% of net profit in dividends, making a payout of about 80 billion rubles, out of which 58.7 billion would be on its preferred shares. This would make the highest payout since 2015.

In 2018 Surgut became the investment banks' top pick as a massive 19% dividend yield are expected to be paid.

Since the consolidation and privatisation of state oil assets in western Siberia in the early 1990s, Surgut has been headed by Vladimir Bogdanov, regarded as something of a sector "dinosaur" by his rivals for his shunning of western debt, technology, accounting standards, foreign partnerships and Moscow as he largely lives on the site of the oilfields.

The head of Surgut is believed to have close ties to the Kremlin. Unnamed banking sources told Bloomberg in the past that in 2000 Bogdanov helped finance Putin's first presidential campaign. Investor agitator Bill Browder also once claimed that Putin personally owns a piece of Surgut and told bne IntelliNews it was Surgut that had his visa pulled for making this claim in public.

Bogdanov believes Putin is infallible in his choices for the country and says he will use the financial resources of Surgut, which he calls "the people’s company", in whatever way the president requests, Alexander Ryazanov, a former deputy head of gas exporter OAO Gazprom, said in an interview to Bloomberg in the past.

The company is also believed to be behind the Baikalfinansgrup that bought out the main assets of the bankrupted private Yukos oil company at a controversial auction in 2004, which were ultimately repurchased by Kremlin-controlled Rosneft.

This piece first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.