Global arms sales are on the increase, consistent with the growing number of conflicts and deaths brought about by them. The U.S. and its allies have been the main beneficiaries. Russia, by contrast, is on the decline, a sign that Vladimir Putin’s geopolitical bets aren’t turning into long-term influence.

The world has grown significantly less violent since 1950, but there has been an marked uptick in the number of armed conflicts in recent years. The emergence of Islamic State, hostilities in eastern Ukraine, and the persecution of the Rohingya in Myanmar are just some examples.

The number of fatalities has increased even more dramatically, according to the Uppsala Conflict Data Program. Between 2011 and 2017, the average annual death toll from conflict neared 97,000, three times more than in the previous seven-year period.

That helps to explain the 7.8 percent increase in international arms transfers from 2014 to 2018 compared with the previous five-year period seen in the latest data from the Stockholm International Peace Research Institute, the global authority on the weapons trade. The Middle East has been absorbing weapons at an alarming pace: The flow of armaments to the region rocketed by 87 percent in the last five years.

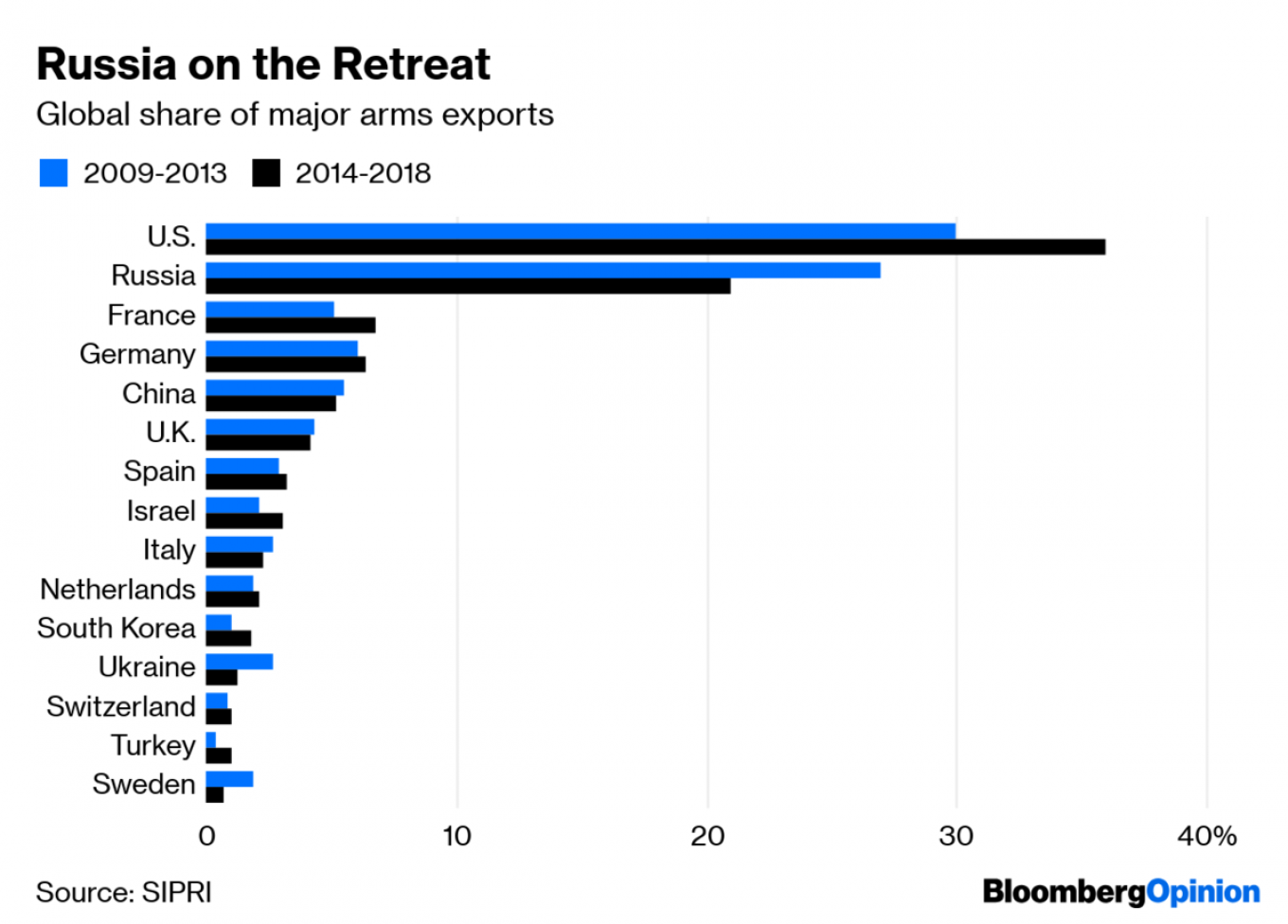

Russia took an active part in the bloodiest of the conflicts, but it doesn’t appear to have been able to convert this into more sales. It was the only one of the world’s top five exporters, which together account for 75 percent of the business, to suffer a major loss in market share. It remains the world’s second-biggest arms exporter.

SIPRI has its own, rather complicated, system for calculating transfer volumes based on the military value of the equipment traded rather than on its market price. But in dollar terms, too, Russia trails the U.S.

Yury Borisov, Russia’s deputy prime minister in charge of the defense industry, said last month that Russia “steadily reaches” $15 billion in arms exports a year and hopes to retain that amount. This suggests officials believe sales have hit a ceiling.

By contrast, the U.S. closed $55.6 billion of arms deals in 2018, 33 percent more than in 2017, thanks to the Trump administration’s liberalization of weapons exports. According to the SIPRI figures, U.S. exports were 75 percent higher than Russia’s in 2014 through 2018 – a far wider gap than in the previous five-year period.

For the U.S., Middle Eastern countries have been especially important – particularly Saudi Arabia, the world’s largest arms importer, and its major irritant, Qatar. Some 52 percent of U.S. weapons sales were to the Middle East in the last five years. Under President Donald Trump, the relationship with Saudi Arabia became even more lucrative for the defense industry.

For Russia, the Middle East accounted only for 16 percent of its weapons exports over the same period, with most going to Egypt and Iraq. Its major trade partners were India, China and Algeria – but sales to India dropped significantly as its government sought to diversify suppliers and bought more from the U.S., South Korea and, most painfully for the Kremlin, Ukraine. Russia has been losing key aircraft tenders in India to the U.S. This, along with the economic collapse of another major client, Venezuela, and the current potential for regime change in Algeria, all makes a rebound in Russian sales look unlikely.

Arms sales are perhaps the best reflection of a major military power’s international influence. The market isn’t all about price and quality competition; it’s about permanent and situational alliances. The growing gap between the U.S. and Russia in exports shows that Putin’s forays into areas such as the Middle East are failing to translate into Russian influence in the region. Although Putin’s warm relations with Egyptian President Abdel-Fattah el-Sisi and his alliance with Iran, which has a lot of influence over Iraq, are paying off to some extent, they can’t quite compensate for ground lost elsewhere.

The U.S.’s allies, France, Germany and the U.K. among them, have been rapidly increasing their market share, too. That’s a rarely mentioned way in which the security alliance with Washington is paying off for the Europeans. All the ethical objections to selling arms to countries such as Saudi Arabia notwithstanding, European Union member states need markets for their defense industries, which employ about 500,000 people. Being under the U.S. umbrella opens doors where Russia and China are less desirable partners – that is, in most of the world.

Many tears have been shed in the U.S. about the collapse of the American-led global order. But if you take arms sales as a proxy for influence, the U.S.’s global dominance looks to be resilient. In a more conflict-prone, competitive world, America is doing rather well while its longstanding geopolitical rivals stumble.

This opinion piece was first published by Bloomberg View.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.