Pressure is building on Russia's Central Bank to support the ruble via a big rise in interest rates at this week's policy meeting, as money markets price in sharply higher funding costs in the coming months.

The bank, which so far has been powerless to stem the ruble's slide, meets on Thursday and analysts predict a 100 basis-point rise in the key lending rate, taking it to 10.5 percent.

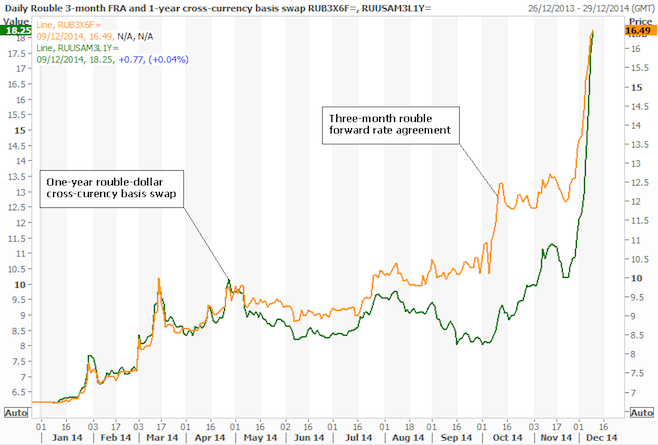

Three-month forward rate agreements (FRAs), that allow traders to lock in existing market interest rates for six months, have jumped to 16.5 percent, up 1.5 percentage points from the end of last week and 400 bps higher than end-November levels, the following graphic shows:

What that means is that ruble deposit rates starting three months from now and lasting six months will rise to 16.5 percent — seven percentage points above current official lending rates. Official rates have been raised by 400 bps already this year.

"There is intense market pressure on the Central Bank to hike rates this week and any shortfall will lead to significant volatility across Russian assets," said Bernd Berg, director for EM strategy at Societe Generale.

"You see significant panic in the rates markets. The Central Bank must come in and address the panic with a combination of higher rates and tighter liquidity."

Indeed, signs are authorities will also squeeze money market liquidity to support the ruble. Turkey adopted such a strategy last year, determining interest rates almost daily by controlling the amount of domestic currency available to banks.

One-year cross-currency swap rates have shot above 18 percent, almost 300 bps above last week's closing levels.

Ruble/dollar cross-currency swaps show the cost of funding in rubles relative to that in dollars. A rise in one-year ruble/dollar basis swap reflects the scarcity of rubles in the system as a result of Central Bank action.

And Mosprime reference rates, based on contributions from leading Russian banks, show one-month deposit rates at 13.35 percent, up 150 bps over the past week.

"There's a change in strategy at the Central Bank, which is moving away from intervention to liquidity tightening similar to what Turkey deployed. To that extent it makes the main policy rate somewhat less important," UBS strategist Manik Narain said.

The picture is similar in Nigeria, where overnight rates have spiked after the Central Bank drained liquidity and raised interest rates.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.