Since Vladimir Putin launched his full-scale invasion of Ukraine in 2022 and plunged the world into an economic war alongside it, the Russian president has had three asks of his Chinese counterpart, Xi Jinping.

The first is political-military support for his war, followed closely by a deal on the Power of Siberia 2 Pipeline and unfettered access to Chinese financial markets.

In the past week, Putin has finally come close to securing all three.

The Power of Siberia 2 (PoS 2) pipeline is crucial for Russia’s future status as a global energy exporter. The new pipeline, when constructed, is supposed to carry up to 50 billion cubic meters (bcm) annually — and Xi and Putin also agreed to raise the capacity of the existing Power of Siberia 1 pipeline from 38bcm to 44bcm. Together with another link with Russia’s Far Eastern gas projects, if PoS 2 is completed as planned by 2030, Russia would deliver over one-fifth of projected Chinese demand via its pipeline network.

Crucially for loss-making Gazprom, PoS 2 would also provide a substantial outlet for replacing pipeline gas exports to Europe that have fallen 90% from 2021 to today, with only its export routes via Turkey remaining.

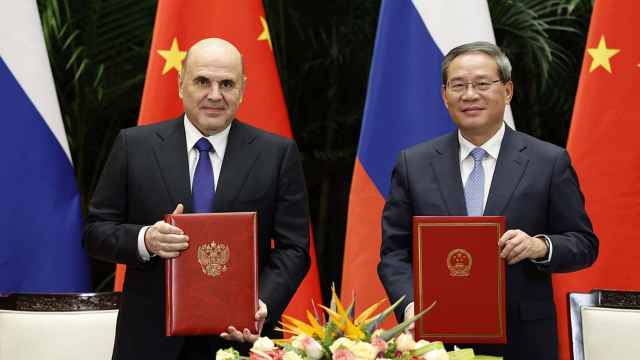

While the PoS 2 memorandum was signed on the back of the Shanghai Cooperation Organization summit, China sent a clear signal on the eve of the summit that it may be willing to help absorb Putin’s gas glut even further.

On Aug. 28, Russian LNG carrier Arctic Mulan unloaded its cargoes at the Beihai LNG terminal in China’s Guangxi province - the first–ever delivery of Russian LNG from the US-sanctioned Arctic 2 LNG export facility. Arctic-2 LNG came online last year but was placed under the most wide-reaching U.S. sanctions before that, including a threat of secondary sanctions. It had been unable to sell a single cargo to any foreign buyer, with Russia’s fleet of LNG carriers facing a far greater difficulty of evading sanctions than its oil shadow fleet.

If Beijing’s acceptance of the Arctic 2 LNG cargo was a signal of its increased willingness to shrug off concerns about the potential for U.S. sanctions on its own entities, a report in the Financial Times on Sept. 7, that Beijing would allow Russian entities to begin issuing so-called panda bonds at large scale is a flashing red light.

Chinese banks and investors have largely avoided Russian entities in the three-and-a-half years following the introduction of sanctions on most facets of the Russian economy, but Beijing is now reportedly preparing to give a signal to its financial market that such deals should be approved.

A panda bond is a Chinese yuan-denominated loan issued by a non-Chinese financial institution on the Chinese market. No Russian firm has been able to issue such a loan since the full-scale invasion of Ukraine, even as the issuance of non-public loans in the Russian market denominated in yuan has increased substantially and the Kremlin has prioritized enabling access to yuan for Russian companies.

While non-sanctioned Russian entities are reportedly set to be the first to tap the Chinese panda bond market, there are already signs that Beijing is considering opening the door further. Gazprom — which is not under the U.S.’ most strident blacklisting sanction, but does face sectoral sanctions aimed at barring the issuance of all but the most short-term credit — received a triple A, the highest grade, credit rating from Beijing-run agency CSCI Pengyaun on Sept. 5. Such a move is a prerequisite for the issuance of its own panda bonds, and the sky-high rating a sign that Beijing would support such a move.

The about-face on accepting Russian LNG with a clear sanctions risk, the decision to proceed with Power of Siberia 2 — although crucial pricing terms still have to be agreed – and the opening of Chinese financial markets to Russian state entities is a remarkable turnaround from the beginning of the year. Chinese banks had moved away from enabling currency trade with Russia at following a round of U.S. sanctions in the Biden Administration’s final week in office this January that targeted one such network aimed at facilitating trade in the defense sector.

While some such evasion did occur — and limited amounts of Chinese kit have been discovered on Ukraine’s battlefields — Beijing was careful to lean too far in Moscow’s direction. China only allowed small banks to be involved in facilitating trade following earlier Biden Administration sanctions on the Chinese branch of Russia’s VTB bank and had quietly rejected earlier pleas from Putin for allowing Chinese yuan settlement of Russian trade with other third countries. Putin ominously amended his request to create joint settlement structures amongst the SCO members at the bloc’s summit on Sept. 1.

These developments have not come in a vacuum. They come as President Donald Trump’s Administration has failed to enact a single new sanction against Russia since coming to office, except for a tariff targeting India that Beijing has managed to avoid despite buying more Russian oil than New Delhi.

Beijing has clearly been emboldened to increase its support for Putin’s Kremlin and Russia’s struggling economy. It can be cowed into reversing – by the blacklisting of Gazprom itself, and demonstrations by the Trump Administration that the secondary sanctions threat still carries bite, for example, by sanctioning entities connected to the Arctic 2 LNG offtake.

On Sept. 6, Trump posted to social media that “we” had lost “Russia to deepest, darkest, China”. In fact, his inaction has pushed China further into Russia’s camp. By failing to prioritize the mortal threat posed by Russia over his perception of the risks posed by China, Trump has only further enabled both.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.