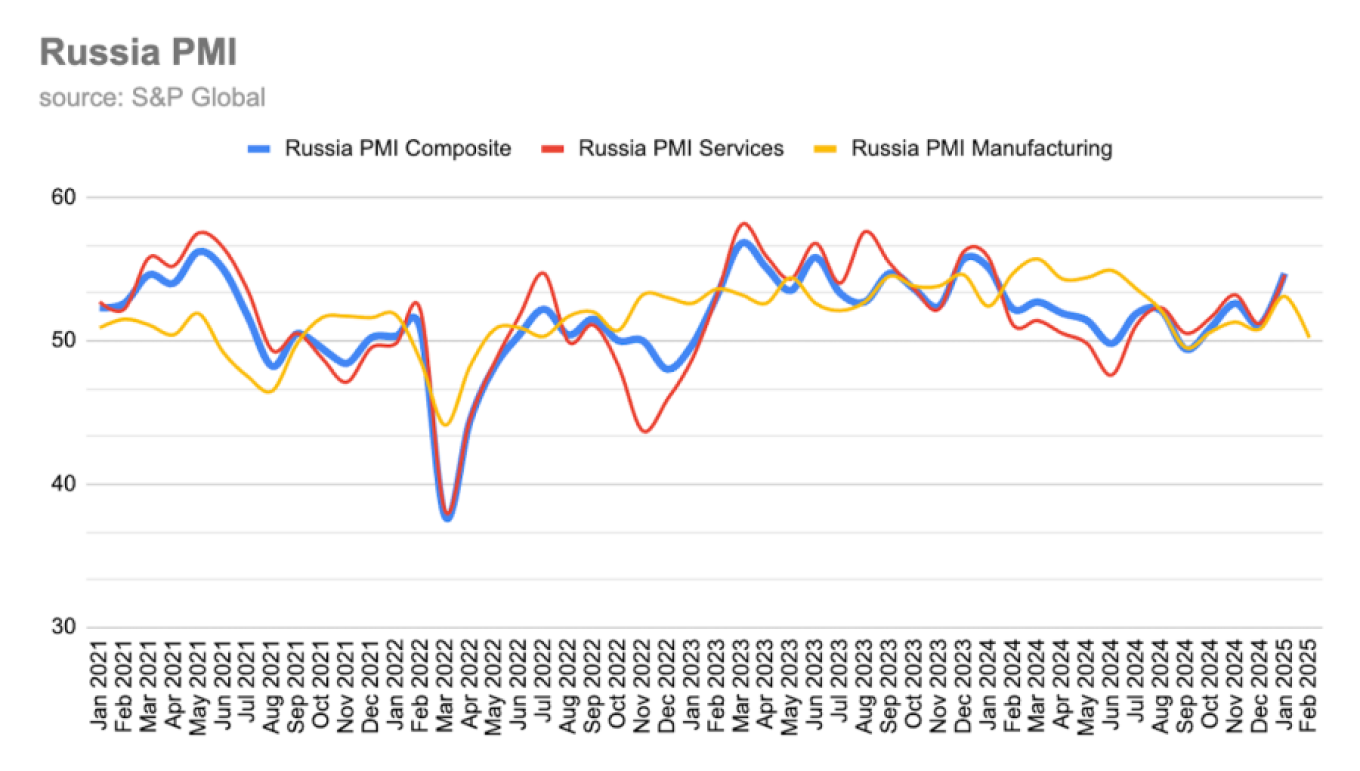

Russia’s manufacturing sector PMI slumped back to 50.2 in February from 53.1 in January as Russia’s economy shows the first concrete signs of cooling, according to the latest report by S&P Global released on Monday.

The result marked the slowest expansion in five months, S&P Global said.

"The latest data signaled only a slight improvement in the health of the goods-producing sector, and one that was the slowest in the current five-month sequence of growth," S&P Global said in its report.

While some firms reported stable demand conditions, others pointed to stagnation in new orders, contributing to the weaker performance.

The pace of output growth also declined, expanding at only a marginal rate. This marked the slowest increase in the past four months, reflecting muted demand conditions across the sector. The report noted that new orders had broadly stagnated, with the seasonally adjusted index falling to its lowest level in four months.

A PMI reading above 50 indicates an expansion in business activity, while a figure below this threshold signals a contraction.

The latest data suggest that while Russia’s manufacturing sector remains in growth territory, momentum has slowed considerably amid softening demand.

A fierce debate is currently underway amongst economists with some arguing that the sky-high interest rates of 21% and sticky inflation of 10% will lead to a wave of bankruptcies later this year, while others say that the Russian economy is more robust than it first appears and the chance of a crisis remains low. A recent paper argued that the state has been forcing banks to make soft loans to the defense sector and will lead to a credit crisis.

However, Central Bank Governor Elvia Nabiullina said that Russia’s non-performing loans (NPLs) remain at around 4%, a manageable level.

Nabiullina told the State Duma earlier this year that her non-monetary policy methods to cool the economy are working and that inflation will fall in the coming months.

Analysts concur that easing of monetary policy is unlikely to start this year, unless there is a ceasefire deal on the Ukraine conflict — and even then cuts remain unlikely as the Kremlin will likely continue heavy military spending as it needs to rebuild its military and restock after three years of fighting.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.