Rumors that Russia’s sovereign debt would be branded “junk” by major credit rating agency Standard & Poor’s hung over the markets on Friday, driving the ruble to new historic lows and stoking fears of a new surge of capital outflow from Russia’s beleaguered economy.

On Friday, however, S&P held to its previous rating, while maintaining its negative outlook.

“The negative outlook reflects our view that we could lower our ratings on Russia over the next 18 months if its external and fiscal buffers deteriorate faster than we currently expect — for example, due to any further tightening of sanctions as a result of the conflict in Ukraine,” S&P said its statement.

In its last review on Russia released in April, Standard & Poor’s issued a negative outlook and cut Russia’s rating to BBB-, a mere notch above its “speculative” classification. This was followed by Moody’s Investors Service, which downgraded its rating from Baa1 to Baa2 two weeks ago, also with a negative outlook.

As the markets waited for S&P’s scheduled update on Friday, investment bank UBS on Wednesday said the agency’s negative outlook meant that Russia’s sovereign rating might be downgraded even further.

On Thursday, analysts at the Royal Bank of Scotland added fuel to the fire by saying the rating could be brought down two notches instead of one, putting the country’s sovereign debt well into the “junk” status.

Had that happened, the result would have likely been an investor stampede out of the market, analysts said.

“This particularly deep possible downgrade was scaring investors more than the actual low rating itself because such a decline was not initially expected and would have forced them to take unexpected action,” Yevgeny Nadorshin, chief economist at Russian conglomerate AFK Sistema, said Friday.

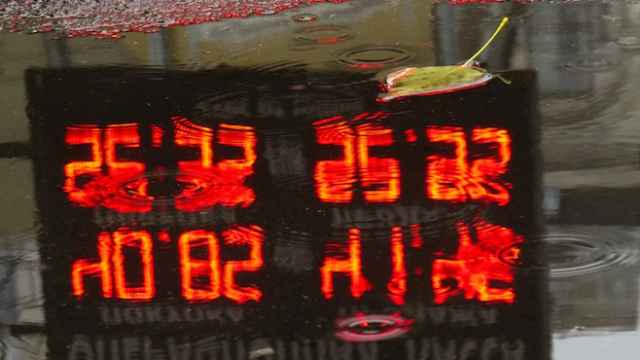

Rumors of a possible sovereign rating downgrade had been weighing down the ruble all week. The national currency fell to 41.9 rubles per U.S. dollar on Friday, and has lost more than 25 percent against the dollar and 18 percent against the euro since January.

Oil and Sanctions

The double blow of Western sanctions limiting Russian access to foreign capital and low oil prices ravaging the state budget has been the most decisive factor in determining the agencies' negative outlook.

Oil prices have stayed low for four months straight and were this week close to $86 per barrel, the lowest level reached since 2012. Experts estimate that each $1 decline in the price for Urals crude oil takes a toll of 70 billion rubles ($1.7 billion) from the state budget, which is currently calculated under the assumption that oil stays around $100 a barrel.

Against the backdrop of low oil prices, sanctions are severely limiting the access of Russian banks and companies to Western capital, provoking a deficit in foreign currency.

According to a report by Sberbank CIB cited by news website Slon.ru, Russian companies will have to pay out more than $100 billion of external debt by the end of next year. Russia's banking system can provide roughly half of the sum, the report said, thus leaving a deficit of over $50 billion, which would have to be found elsewhere.

In this situation, the companies would have to heavily rely on help from the government, Sberbank CIB analysts said, adding that state support was also needed to prop up the weak ruble.

With an outstanding debt of over $35 billion, Russia's biggest dollar borrower is state-owned oil giant Rosneft, which must pay out more than $16 billion in the first half of 2015.

Rosneft has already turned to the government for support and requested more than 2 trillion rubles ($49 billion) from Russia's National Welfare Fund. The amount requested is equal to 60 percent of the fund, which held 3.2 trillion rubles ($83.2 billion) as of Oct. 1. Last week the Energy Ministry approved Rosneft's request, although government officials said the company is likely to receive just a portion of what it has asked for.

Privately-owned gas company Novatek is also in the running to scoop up $3.9 billion from the welfare fund. And oil major LUKoil has said earlier last week it was going to file for support as well, not specifying, however, how much exactly it was trying to receive.

Will the Rating Hold?

Some analysts on Friday did not see any particular macroeconomic indicators that would prompt agencies to lower Russia's rating further.

"The last decrease of the rating by S&P was more politically than economically motivated, and although currently the economy is not in very good shape, we do not see grounds for another downgrade," said Alexei Yegorov, a debt market analyst at financial consultancy PSB Research.

Vladimir Tikhomirov, chief economist at finance firm BKS, also found no macroeconomic reasons why the rating could be decreased further.

"The only possible reason for this would be the growing risk caused by the limited access that Russian companies and banks have to foreign capital because of sanctions, which in turn increases the pressure on state reserves to bail them out," he said.

But so far, the reserves are substantial, the debt is low, and the macroeconomic situation is not critical, Tikhomirov said.

Sistema's Nadorshin disagreed, saying the government's readiness to help companies during such a time of need puts too much pressure on the nation's reserve funds. The large amount of bailout money companies are asking for is also a cause for alarm, he said.

"Unfortunately, the negative outlook sustained by the rating agency speaks for itself," Nadorshin said. "When the rating is revised again, there is a real possibility that it will be downgraded because the economic forecast for the next few years is grim while requests for [government] support are coming from all directions already today."

Contact the author at [email protected]

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.