Trouble between Turkey and the Kurds led oil prices to rise to $59 per barrel on Sept. 26, their highest level in more than two years.

Kurds held a referendum in their enclave in Iraq calling for setting up an independent Kurdish homeland for the ethnic group, who spill over the borders of neighboring Turkey, Iran and Syria.

Turkish President Recep Tayyip Erdogan has been an implacable opponent of Kurdish identity. He has come down hard on the group following the referendum, including making a threat to ban exports of oil from the enclave that formerly remains part of Iraq, but in practice is run relatively independently from the center.

Turkey threatened to cut off the 700,000 barrels a day of oil that Iraqi Kurdistan ships to the Mediterranean via a Turkish pipeline. Erdogan is afraid the referendum will provoke Kurds living in Turkey to push for independence as well as to demand more rights to language and separate education. Turkish authorities have been waging a de facto civil war against predominately Kurdish cities in its southern and eastern regions. Analysts doubt that Erdogan will carry through on his threat, but the possibility has been enough to send oil prices soaring.

The jump in oil prices will come as a blessing for Russia, which remains heavily dependent on oil revenues to run its economy. A new three-year budget is about to be submitted to the Duma for approval that has a very conservative estimate of $46 for the average price of oil in 2017, $44 in 2018 and $42 in 2019 and 2020.

But those prices look very low compared to the average of price of oil each month this year, which has bounced between a low of $46.17 in June and a previous high of $54.3 in February. Average monthly oil prices have been over the $50 mark in five out of the last eight months.

Underestimating the oil price in the budget has been a favorite habit of the Duma in the boom years. The result is that significant “surplus” funds are generated each year that deputies could then assign to pet projects, which are a major source of corruption.

More recently the prudent liberal fraction in government introduced a “budget rule” where the estimate of oil prices was averaged over the last three years and that was used to set the budget estimate.

The estimate is important as it dictates the amount of money the government can spend and plans have to be made to fit the projected revenue. Using an average over several years was supposed to remove some of the unpredictability; however, following the collapse in oil prices in 2014 from more than $100 to under $50, the government has been forced to abandon the rule for the meantime.

Still, the higher than budgeted price of oil has already made itself felt. While the share of oil revenues in total federal revenues has fallen steadily from more than half to between 25 and 30 percent now, Russia is still heavily reliant on the petromoney. In 2016 the Ministry of Finance faced a major crisis as it was short some RUB2 trillion of revenues to pay for everything, even with a hefty deficit, as the average price of oil in 2016 was $43.

Russia’s economy doesn't work at $40 oil and has a deficit of more than 3 percent of GDP and has to tap international capital markets to fund the difference. The economy struggles through with $50 oil with a federal budget deficit on the order of 2 percent but can finance the deficit entirely from domestic resources.

Anything above and the deficit falls to under 1 percent and the deficit is easy to cover. Currently, the breakeven price of oil for the deficit is around $70, down from $115 in the boom years, and it is continuing to fall.

The rise in oil will have several positive effects on Russia. One rule of thumb is each $10 rise in the price of oil results in an additional 2 percent of GDP growth.

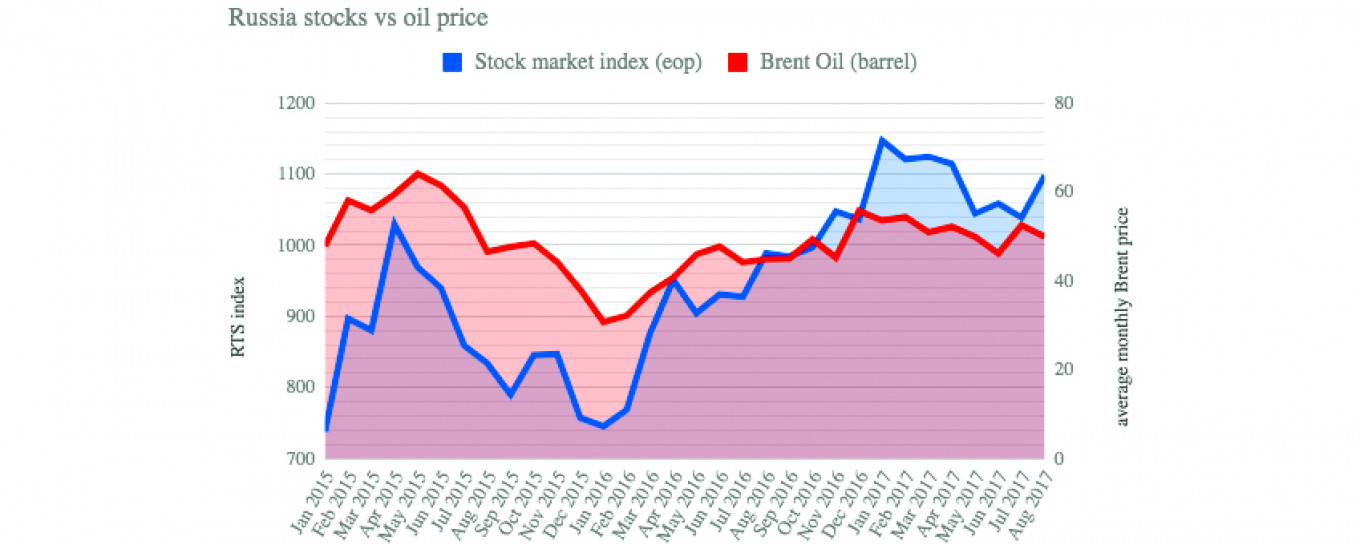

Another rule of thumb is the dollar-denominated Russia Trading System (RTS) index is simply 20-times the price of oil. At $50 the RTS index should be 1,000 and indeed the index has been trading around 1,000 for more than a year now. Stocks started to gain on the recent rising prices of oil and at $59 the index should be 1,180 and at the time of writing the index was 1,138.

The ruble is obviously affected by a sharp change in the cost of oil and here the rule is that there is a RUB2 change in the exchange rate for each $10 change in oil prices. Again the ruble has been strengthening and gone from trading in the mid- to low-60s to trade at RUB57.6 to the dollar at the time of writing.

It remains to be seen if these higher prices stay, but the higher than expected prices so far this year, above the $46 forecast, mean the Ministry of Finance has already cut its forecast for the amount it needs to borrow this year. Russia's finance ministry reduced the net domestic borrowing programme from RUB1.05 trillion (€15bn) annually to RUB0.87 trillion, according to the draft federal budget, as the deficit is expected to be lower than the 2 percent initially expected.

The Ministry of Finance forecast for growth has also been marginally increased from 2 to 2.1 percent in the last month. And analysts have been predicting a fall in the ruble from the 60s to as low as RUB50 vs dollar, which now looks increasingly likely.

Where does oil go from here? OPEC met again in the last week and say they will stick to their production cut deal signed last year, but the targets remain the same – and Russia has complied with their part of the bargain by cutting 300,000 barrels a day from production so far. The experts have said that demand is recovering with the general global economic recovery but there is still a way to go before demand and supply match.

In Russia, most economists are working on the assumption of $60 oil in the long-term, although some, like Alexander Isakov, the chief economist at VTB Capital, are more pessimistic and predict $50 oil thanks to the increasing efficiency of the U.S. shale oil producers.

But what is clear now is that oil will not return to its previous highs of over $100 per barrel and that this year is going to be a lot easier to cope with for Russia’s finance ministry than any year in the last seven.

Read more at bne.eu

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.