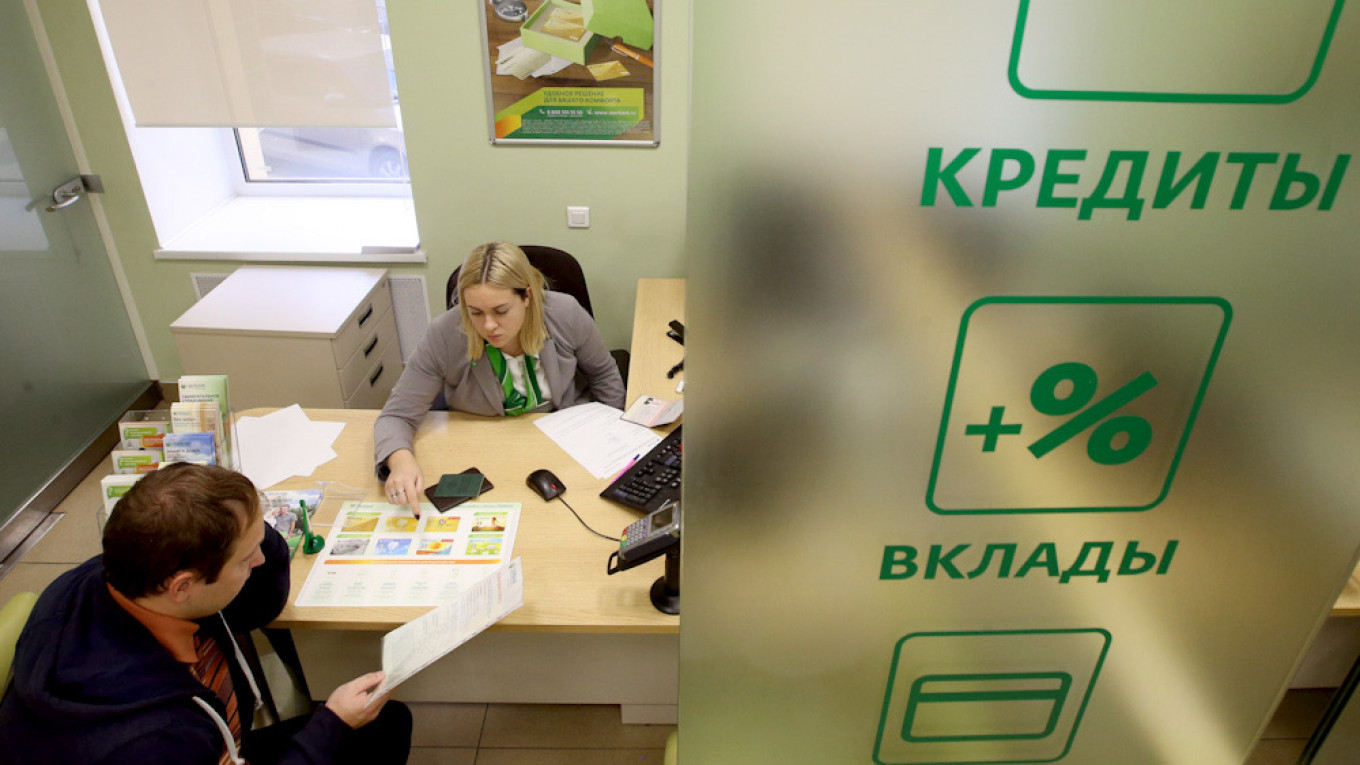

Russia could be in the midst of a payday loan bubble as struggling households load up on short-term, high-interest debt as they come out of the coronavirus recession, a Central Bank representative told lawmakers Monday.

“This year we are already seeing a fairly rapid growth in individuals’ debt burdens, and in some places we can even talk about bubbles,” the Vedomosti business daily cited Ksenia Yudayeva, the Bank’s first deputy chairman, as telling the State Duma’s financial committee in a hearing.

Russian household spending power sank to its lowest level since 2009 in the first months of the year, according to analysis by the Bank of Finland’s Economies in Transition (BOFIT) unit — with the coronavirus compounding years of squeezes on living standards spurred by sanctions over Russia’s annexation of Crimea in 2014 and the Kremlin’s austere economic policies.

In response, households have loaded up on credit to help cover everyday expenses. The number of payday loans issued hit a record high in March, while the volume of loans which are more than 90 days overdue has risen by 20% over the last year to above 1 trillion rubles ($13.5 billion).

It is not the first time Russian regulators have feared a surge in lending, as the coronavirus pandemic dealt only a temporary reprieve to a years-long phenomenon of household spending rising faster than incomes, with the gap being covered by higher borrowing rates. In 2019, the Bank backed a series of measures which capped interest rates and forced banks to keep more capital on hand for the riskiest borrowers.

The Bank is now supporting a new round of draft bills working their way through Russia’s parliament that would compel banks to tell borrowers when a new loan would take them above a 50% debt-to-income ratio — where spending on debt repayments makes up more half their monthly income — Yudayeva said Monday.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.