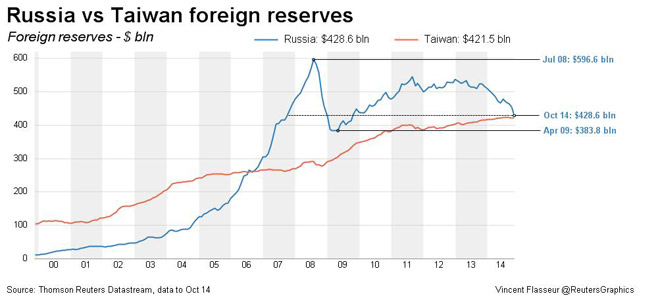

Russia's hard currency reserves have fallen by the equivalent of almost $100 billion in the past year to the lowest since early 2009, contrasting with a rise in holdings in many other emerging economies.

Russian reserves stood at $428.6 billion at the end of October, down from $524.3 a year before due to multi-billion-dollar Central Bank interventions to defend the ruble. They have declined further to $421.4 billion since then.

While the scale of the fall is not on a par with moves seen during the 2008-2009 global financial crisis, when Russia spent almost $200 billion in the ruble's defense, it represents a fall of almost 20 percent from the levels of one year ago.

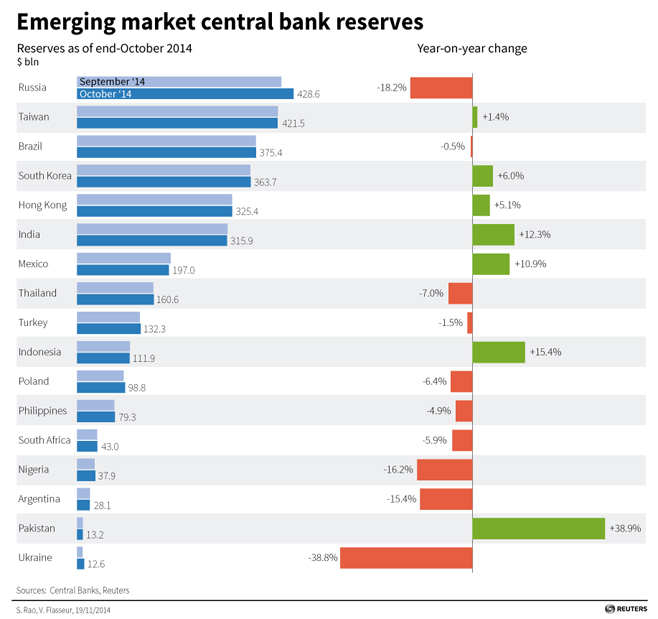

The following graphic shows the state of hard currency reserves in several emerging central banks at the end of October:

Some of the decline is down to valuation effects as the euro, which makes up 40 percent of the reserves, has fallen more than 8 percent this year versus the greenback.

Tatiana Orlova, senior Russia economist at RBS, saw further reserve reduction ahead despite short-term stabilization due to Russia's recent decision to float the ruble.

"The switch to free float is good news for stabilization of reserves. We may expect some intervention from time to time but not the steady drain that we saw in recent months," she said.

Orlova noted also that Russia's headline reserves include $170 billion from two savings funds, the National Wealth Fund and the Reserve Fund. Some of this may be used to help banks and companies hurt by Western economic sanctions, weak oil prices and the slowdown in economic growth.

"The long-term outlook is for a reduction in reserves, the question is how much," Orlova added.

Russian reserves are also now below those of Taiwan for the first time since mid-2006, this graphic shows:

Taiwan's reserves have risen just 1.4 percent in the past year, but those in Indonesia, Mexico and India have gone up by 12-15 percent in this period.

The steepest drop in reserves has been in Ukraine where they fell to $12.6 billion from $20.6 billion a year back.

Nigerian reserves are also sharply lower after heavy central bank interventions to support the naira, which has fallen to successive record lows. Nigeria's reserves are down $7 $7 billion, or 16 percent, from year-ago levels.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.