The ruble slipped on Thursday, eating into gains made late in the previous session, as oil prices hit new lows and the market watched to see whether the Central Bank would be forced into more decisive action to defend the currency.

At 1230 GMT, the Russian currency was about 0.9 percent weaker against the dollar at 46.39 and had lost 1.5 percent to trade at 57.87 versus the euro.

The currency has swung wildly in recent days, buoyed at times by statements from President Vladimir Putin and other government officials that Russia would defend the ruble.

The Central Bank floated the ruble on Monday and has discontinued its regular forex market interventions as part of a long-term policy shift to target inflation instead of defending the currency.

On Thursday, the bank's first deputy governor said the central bank had altered its interventions strategy to "reduce speculative pressure on the ruble."

Ksenia Yudayeva added the bank was against capital restrictions and that it was worth discussing with exporters how they sell their foreign currency earnings.

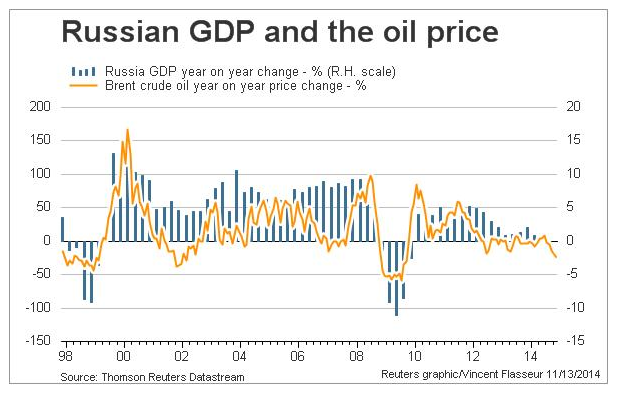

The ruble is down some 30 percent versus the dollar this year, as Western sanctions over the Ukraine crisis have made it harder for banks and companies to refinance debts and as tumbling oil prices have hurt government revenue.

"Market participants are guessing about the Central Bank's next policy step after heavy verbal interventions recently and the limit imposed on forex swap operations," Maxim Korovin, a forex analyst at VTB Capital, said in a note.

"In light of this, we think the ruble's relatively elevated volatility could persist in the near term."

Falling prices for benchmark Brent crude, which slipped below $80 a barrel on Thursday to a new four-year low, weighed on the ruble, as did signs that a cease-fire in eastern Ukraine was all but dead.

But hopes the approaching end-of-month tax period will encourage Russia's exporters to convert their foreign currency earnings into rubles at a relatively attractive rate kept losses in check.

"The current levels of 46.00 to 46.50 are relatively fair for the ruble given current oil prices and modest sales of forex earnings," said Pavel Demeshchik, a forex trader at ING Bank in Moscow.

"Oil will be the main fundamental factor influencing the intraday dynamics of the ruble, if there is a lack of news from the conflict zone in Ukraine."

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.