Russia will need to spend 500 billion rubles ($12.5 billion) from its Reserve Fund to plug holes in the federal budget next year if the ruble and the price of oil don't bounce back from their recent sharp falls, Finance Minister Anton Siluanov said.

The ruble has lost more than 20 percent against the U.S. dollar this year, passing the psychological landmark of 40 rubles to the dollar last week.

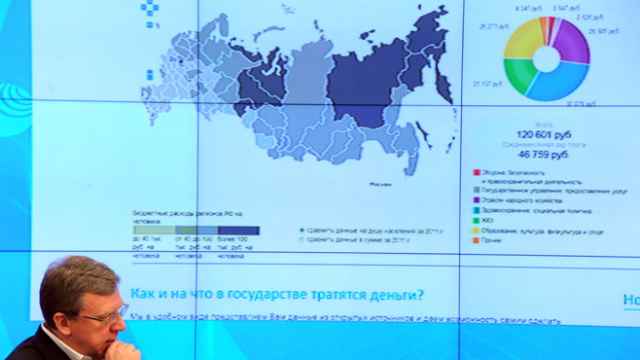

Partly a consequence of Western sanctions and torrential capital outflows, the ruble devaluation has accelerated along with a rapid fall in the price of oil through the third quarter of this year.

"If the current oil price of $87 per barrel remains in 2015 along with the exchange rate of 40 rubles to the dollar … we will be forced to turn to the Reserve Fund," RIA Novosti quoted Siluanov as saying at a session of the State Duma's budget committee on Monday.

Russia's budget for 2015-2017, which was approved earlier this month, is based on the contentious forecast that oil prices will average $100 per barrel next year. The 500 billion ruble infusion cited by Siluanov is the largest permitted under the budget.

One of two state cash stockpiles funded by oil revenues, the Reserve Fund was set up with the explicit aim of covering gaps in state spending when necessary. It contained $90 billion as of Oct. 1, according to the Finance Ministry.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.