Anatoly Chubais, known in the West as the driver of post-Soviet privatization, is counting on his reputation and corporate savvy to attract external investors to Rusnano — the state-owned technology company he has run since its inception in 2007.

Chubais outlined the company's restructuring plans that involve a separation of operational and asset management at a press conference on Wednesday.

"We have been through some quite turbulent events," Chubais told journalists.

He referred to the planning efforts to bring the company to the next level of success, which involves doubling its results after it reaches its stated goal of 300 billion rubles ($8.8 billion) in annual sales, which is expected in 2015. A turnover of 100 billion rubles is planned for this year.

The companies in Rusnano's portfolio create and sell items based on nanotechnology — engineering done on the scale of molecules — to make advanced products in areas like paint components, glass and basalt building materials, medicine and solar panels.

The company now relies solely on state funding to invest in nanotechnology — an industry that it says it started from scratch in Russia.

The restructuring will open the door wide for non-state funding, including from foreign investors. Criticism of Rusnano in April by President Vladimir Putin was immediately followed by scrutiny by the Audit Chamber, which said that the company's performance was not in line with expectations and that hundreds of millions of dollars of state money had been misspent.

Rusnano has invested a total of 134 billion rubles in more than 100 projects, it said in a presentation handed out to reporters Wednesday.

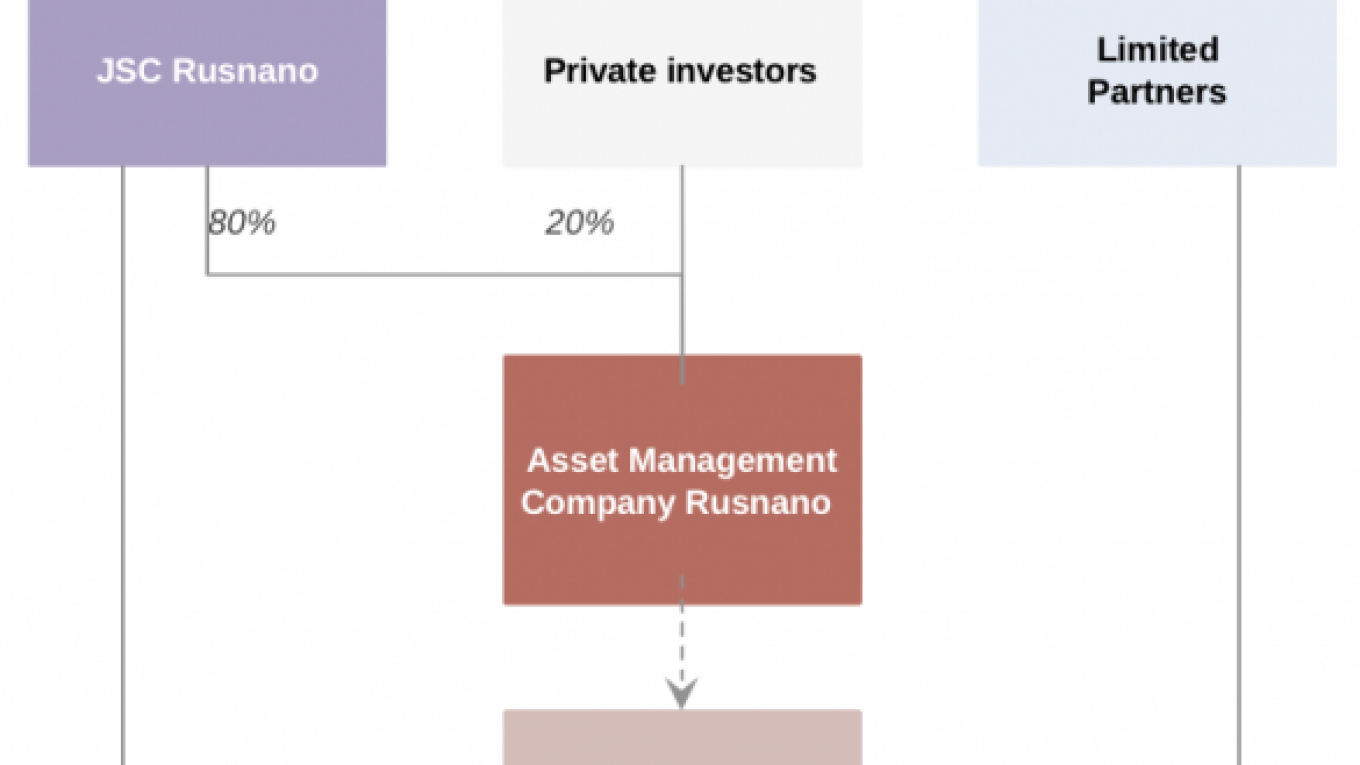

Together with the new strategy, the company set up a subsidiary called Asset Management Company Rusnano, which for now runs the stakes that Rusnano bought with state money in various Russian and foreign nanotechnology companies.

The asset management company is planning to set up its first joint private equity fund with an outside investor — which Chubais said is likely to be a pension fund — as soon as this year, Rusnano said in a statement. Rusnano is willing to contribute half of the proposed 14 billion rubles planned for the fund.

The number of these funds, which will seek to invest in Russia-based nanotechnology and other high-tech startups, will increase over years, the statement said.

Chubais said investors could include foreign pension funds from Europe or the U.S., adding that their mandates usually allow investment of up to 4 percent of their assets in high-risk ventures like the funds that Rusnano plans to set up. Russian law bans Russian pension funds from investing in such ventures, he said.

Rusnano has high chances of succeeding in attracting private foreign financing for its funds, said Eduard Kanalosh, director of the Skolkovo Foundation's department for strategic investor relations.

"It will be an attractive opportunity for many foreign investors to test the waters, which seem too deep from afar, of the Russian investment market — and do it with a reliable and respected local partner," he said.

Chubais is a poster boy for turning around difficult situations. He was the architect of the massive post-Soviet privatizations that helped create a market economy in Russia.

Chubais occupied high Cabinet and Kremlin positions in the rough-and-tumble 1990s and then took on the assignment to dismantle the giant electricity monopoly, Unified Energy Systems, in order to lure private investment to the sector. That effort did not turn out entirely as planned, after Chubais shut down the company and handed the industry back to the government.

Chubais and a few other top managers of Rusnano plan to buy a total of 10 percent in its asset management subsidiary later this year, he said. The company could offer another 10 percent to an outside investor, he added.

Another Rusnano plan is to conclude joint venture deals with truck maker KamAZ to set up a steel moldings business for the auto industry, which now relies on imports. It also is negotiating a deal with steel-pipe maker ChelPipe.

Naming some of the company's more successful projects in an interview to Interfax that came out Wednesday, Chubais mentioned light-emitting diodes maker Optogan, industrial pump maker Novomet and drug maker Niarmedic Farma.

At the news conference, Chubais said Rusnano would likely pass the breakeven point in 2017 and begin paying dividends to the state the next year.

Contact the author at [email protected]

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.