Russian stocks rose sharply Monday in line with a global rally, but market insiders warned that nothing was standing in the way of another tailspin like the one the world witnessed in early August.

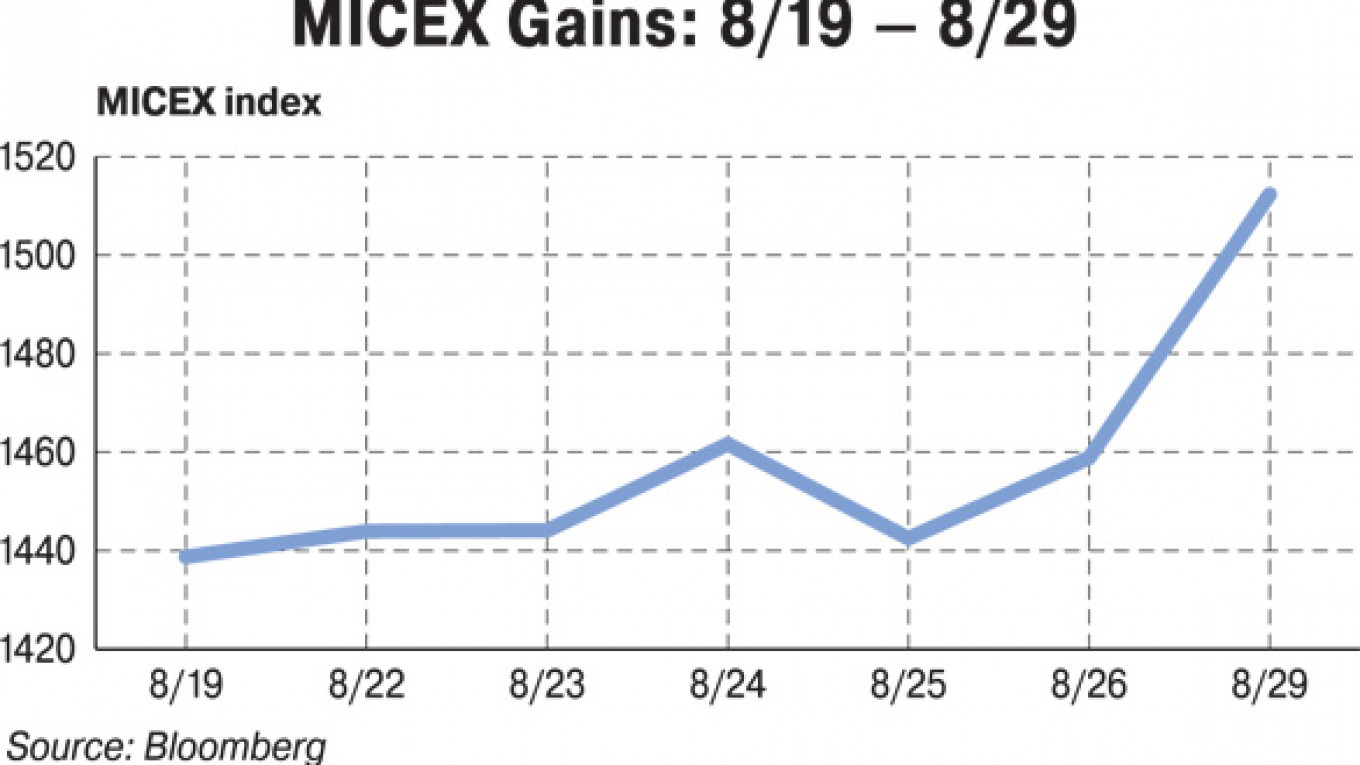

The MICEX Index closed up 3.6 percent at 1,512.36, its highest point since the 1,418.66 bottom hit on Aug. 11, paring this month's loss of 11 percent. The dollar-denominated RTS also saw strong gains, closing up 4.48 percent at 1,667.66 points.

Banks and energy companies led the recovery, with Sberbank advancing 5.2 percent, a 10-month record. Buoyed by a rise in crude prices and oil tax legislation signed by Prime Minister Vladimir Putin last week, Rosneft jumped 7.4 percent, the most in 15 months.

The bullish bourses in Moscow reflected positive international sentiment after a much-anticipated speech by Ben Bernanke, chairman of the U.S. Federal Reserve, on Friday.

Bernanke indicated that the longer-term prospects for the U.S. economy might be better than many current gloomy predictions, and he left the door open for a future fiscal stimulus — a third round of quantitative easing — if the economic situation worsens.

"The market recognizes that assets are crazily cheap right now. … Everybody is looking at everybody else to see who jumps first," said Roland Nash, chief strategist at Verno Capital. "There's a real sense of not wanting to miss out when assets bounce."

But market players stressed that concerns over sovereign debt levels in Europe and the possibility of a "double-dip" recession in the United States — fundamentals that drove the sell-off in early August — have not receded.

There is plenty of scope for fresh panic on the markets, said Peter Westin, chief equity strategist at the Aton brokerage. As investors return from vacation over the next two weeks, there will be a flood of new U.S. economic data, while September and October will see a peak in European debt repayments.

"If anyone goes in [now] with a conviction that we've reached the bottom, I'm afraid that they'll get burnt," Westin said.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.