The government will likely add to its roster of 10 investment banks appointed to handle a 1.8 trillion ruble ($58 billion), five-year privatization program, said Ed Kaufman, head of investment and corporate banking at Alfa Bank.

First Deputy Prime Minister Igor Shuvalov said last month that the list of banks should grow as Russia plans stake sales in about 900 companies.

Alfa, Russia’s biggest private bank, Troika Dialog, Citigroup and Barclays Capital were not included when the government announced in October a list of 10 banks to handle asset sales, including stakes in Rosneft and Sberbank.

“The government seems to be reviewing the process,” Kaufman said in a telephone interview in New York. “It is reviewing applications by a number of banks,” and other lenders may also be added to the list, he said.

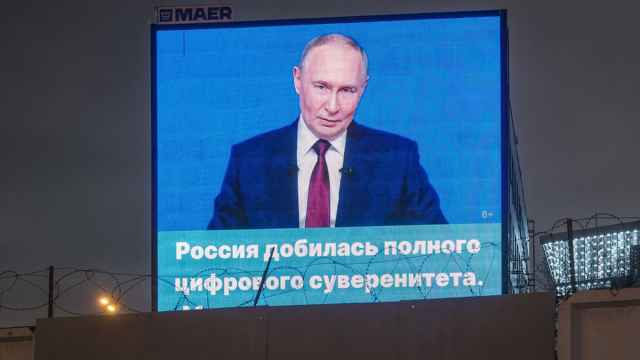

Prime Minister Vladimir Putin’s government approved the plan to sell state holdings after the country had a budget shortfall of 5.9 percent in 2009, its first deficit in a decade.

Russia plans to sell as much as 15 percent of Rosneft, its biggest oil producer, to help balance the budget. The state intends to reduce its holding in Sberbank, the country’s biggest lender, to a controlling stake between 2011 and 2014, Shuvalov said last month.

Goldman Sachs Group and Bank of America’s Merrill Lynch were among 10 advisers that Russia hired last month. Morgan Stanley, Credit Suisse Group, JPMorgan Chase and Deutsche Bank were also selected, along with Renaissance Capital, VTB Capital, Russian Auction House and Vneshekonombank, the government said in an order posted on its web site Oct. 28.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.