The CEO of the Moscow Exchange (MOEX) Alexander Afanasiev has stepped down a year early and will be replaced by Yury Denisov, another capital markets professional, Russia’s biggest bourse said on April 17.

Afanasiev has led the exchange for seven years and overseen a revolutionary change in Russia’s capital markets, which have some trillion dollars of assets under management.

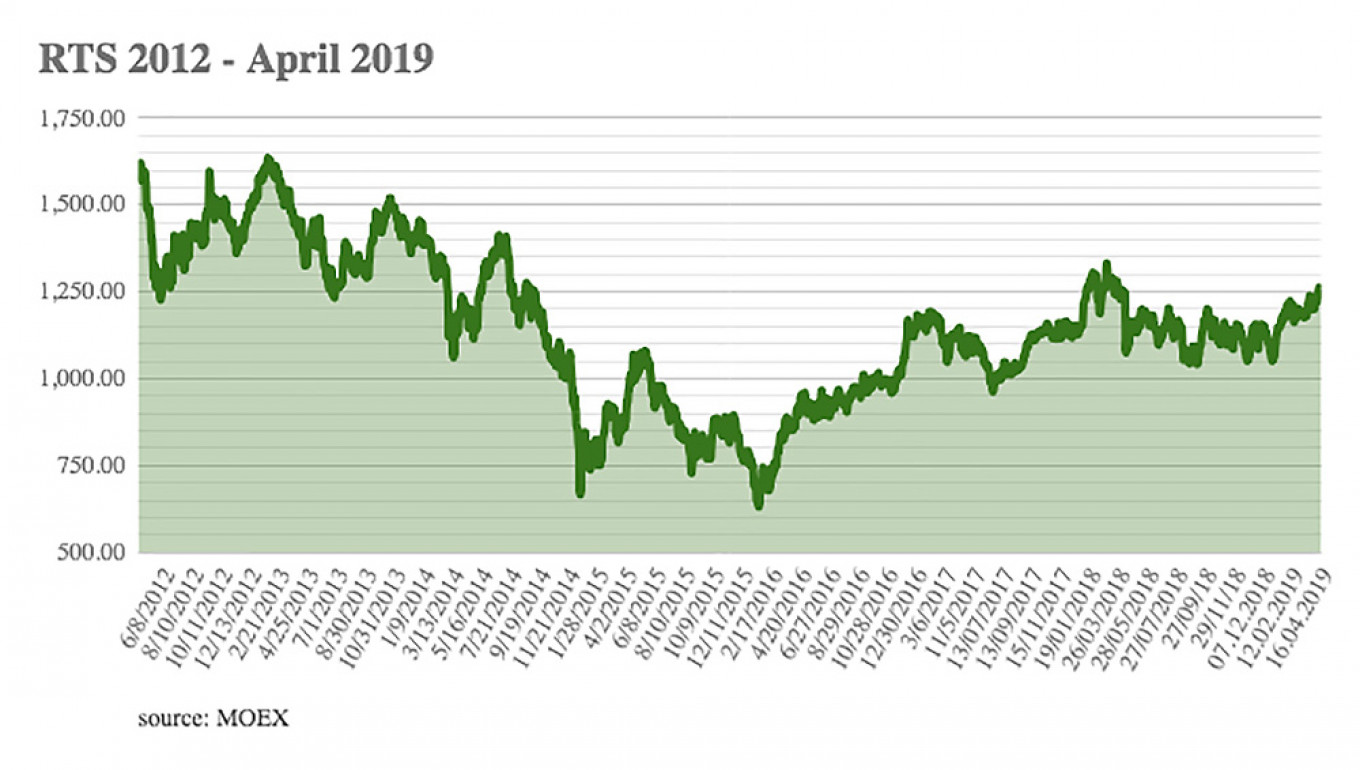

The biggest change was the merging of the dollar-denominated Russia Trading System (RTS) and ruble-denominated Moscow Exchange Index (MOEX) into one hosted on the same platform, although the ruble and dollar indexes remain distinct. At the same time, the two associated depositories were merged and a single central depository created to clear and settle all trades.

Finally, Afanasiev oversaw hooking Russia’s exchanges into the Clearstream and Euroclear international payment and settlement systems, giving international investors direct access to Russia’s stocks and bonds from dealing desks around the world.

Tie-up

The tie-up with the international settlement services had a radical effect on Russia’s financial markets, as billions of dollars flooded into the Russian bond market. Today, foreigners account for 30 percent of all the outstanding OFZ treasury bills.

The ease of access for foreign investors also effectively killed off many of the independent investment banks, which used to earn fat fees from trading on the Russian exchanges on their clients' behalf. Stephen Jennings, the former CEO of Renaissance Capital talked about a “killing zone” in between the barbell weights of the really big banks and really small banks — assuming Renaissance was at the big end — only to fall victim to the killing zone himself. Ruben Vadanian’s Troika Dialog was sold to state-owned Sberbank to become its investment arm Sberbank CIB.

Today the Russian stock market plays an important role as a source of funding for the government, as it can now increasingly tap international capital by issuing ruble-denominated bonds and reduce its exposure to forex risk. That has been a boon and allowed the Finance Ministry to keep its Eurobond issues — the usual way for emerging market governments to raise international capital — to a minimum.

The markets are also an important source of capital for companies that have raised money to fund their growth. Shoe retailer Obuv Rossii, which caters to Russia’s middle classes living in the regions, raised $105 million through an initial public offering (IPO) in October 2017 to fund new stores, and has seen its business grow steadily since.

And the domestic exchanges will underpin the development of Russia’s pension and insurance businesses.

MOEX's board of directors have proposed Denisov to replace Afanasiev, although the appointment must still be approved by the government. The exchange said Afanasiev is leaving because he has achieved most of the goals on his agenda ahead of time.

Denisov will take over the company’s new five-year strategy, which he helped draw up, that will be presented in early July. Denisov has over 25 years of experience in Russia’s capital markets.

From 2002-10, he was senior vice president and head of Treasury at VTB. In 2010-11, he was deputy CEO at MOEX. During this time, he was involved in the development of new financial instruments and services, and was responsible for the establishment of a fully-fledged central counterparty and financial risk-management function, as well as the development of the group’s cash management system. Most recently, Denisov has been a member of the supervisory board, from 2008 to 2011, and again from 2013 until the present, reports VTBC.

Strategic planning

At various times, he has chaired the board’s risk committee, the business standards and practices committee, and the audit committee. He has also served as a member of the strategic planning committee, the nomination and remuneration committee, and the budget committee. He is currently chairman and a member of Russia’s central depository NCC, a key piece of financial infrastructure for the market.

The markets welcomed Denisov’s appointment, saying he will continue to develop the market, and that his long experience of working with MOEX ensures continuity.

“The new five-year strategy is scheduled for presentation in July. As the departing and the new CEO were deeply involved in its preparation, we expect continuity. Our key focus will be on improving operating efficiency and addressing the still negative operating jaws, as well as on capital allocation, including an updated dividend policy,” Svetlana Aslanova of VTB Capital (VTBC) said in a note.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.