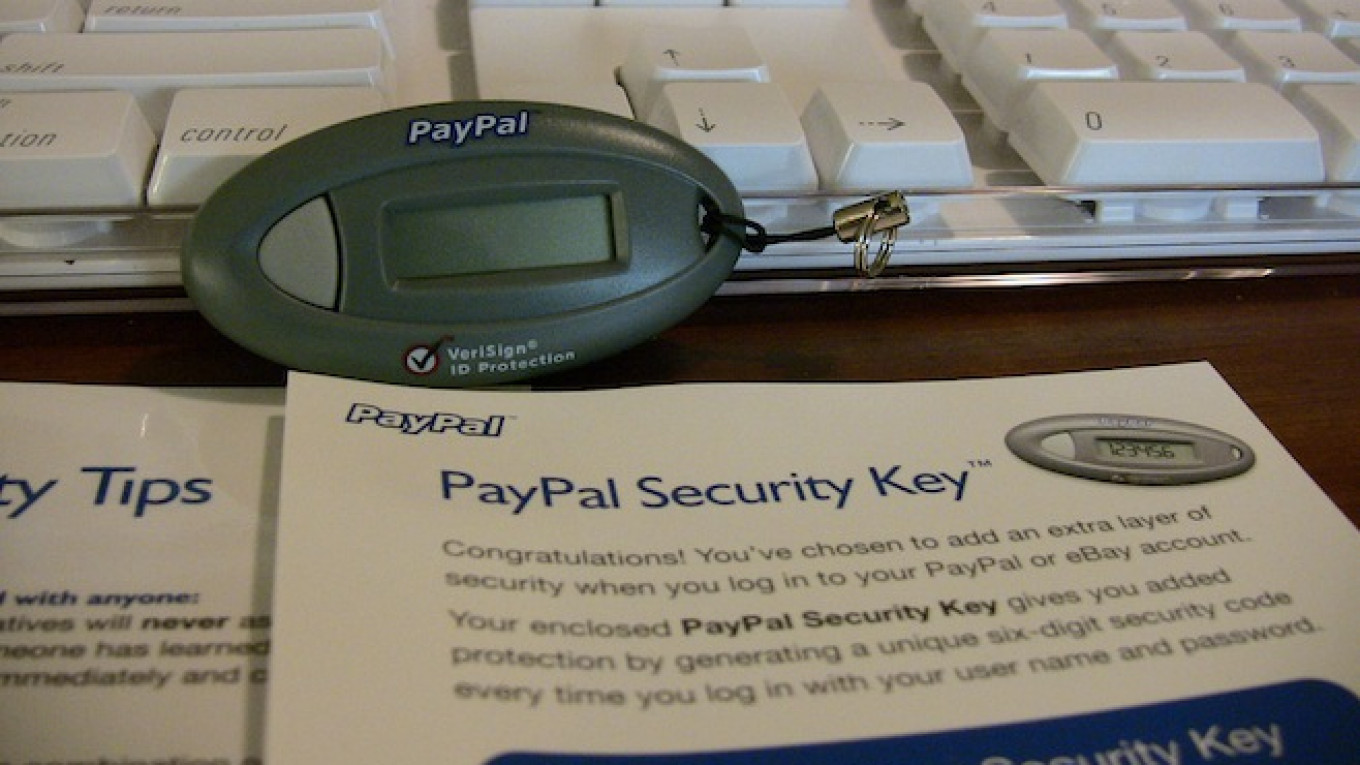

A State Duma committee is preparing legislation that would require foreign Internet payment systems such as PayPal and WebMoney to pay hefty security deposits to continue operating in Russia, the same measure that risks pushing Visa and MasterCard out of the Russian market, a United Russia deputy told Izvestia on Thursday.

Deputy Yevgeny Fyodorov, who sits on the Budget and Taxation committee, said that the mandatory security deposit would supply an "air bag" to protect Russian users in the event of foreign sanctions. The bill includes an array of other limitations on the payment systems operations, he added.

Foreign payment systems have found themselves at the center of a cycle of Western sanctions and domestic retaliation following Russia's annexation of Crimea. Visa and MasterCard took the Russian financial sector by surprise in March when they cut services to two Russian banks sanctioned by the U.S. Treasury. President Vladimir Putin responded by declaring dependence on foreign electronic payment systems a national security issue and calling for the creation of a domestic alternative.

Preparations for the launch of Russia's national payment system are now well underway, while Visa and MasterCard's future in Russia remains uncertain. A bill passed in May would require the two companies to pay a massive security deposit — estimated at $2.9 billion by Morgan Stanley — to continue their operations in Russia. The Duma last week began discussing amendments to soften the law.

The government has been intensifying regulation of all online payment systems, foreign-owned and otherwise, throughout the year. Legislation signed into law in May banned anonymous payments between individuals of over 15,000 rubles ($435) per day and set a limit of 40,000 rubles per month.

See also:

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.