The future of capitalism is again in question. Will it survive the ongoing crisis in its current form? If not, will it transform itself or will governments take the lead?

The term "capitalism" used to mean an economic system in which capital was privately owned and traded. Owners of capital got to judge how best to use it and could draw on the foresight and creative ideas of entrepreneurs and innovative thinkers. This system of individual freedom and individual responsibility gave little scope for governments to influence economic decision-making. Success meant profits, while failure meant losses. Corporations could exist only as long as free individuals willingly purchased their goods and would otherwise go out of business quickly.

Capitalism became a world-beater in the 1800s when it developed capabilities for endemic innovation. Societies that adopted the capitalist system gained unrivaled prosperity, enjoyed widespread job satisfaction, obtained productivity growth that was the marvel of the world and ended mass privation.

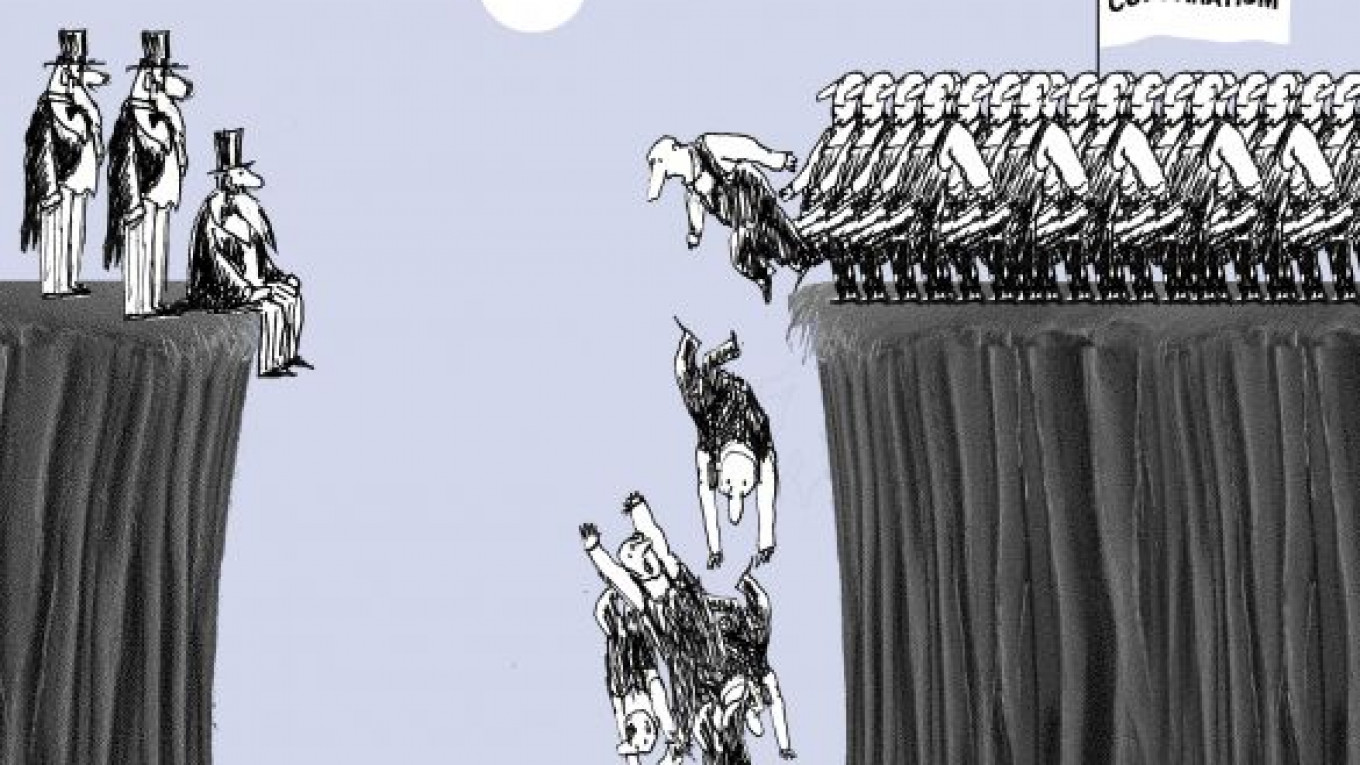

Now the capitalist system has been corrupted. The managerial state has assumed responsibility for looking after everything from the incomes of the middle class to the profitability of large corporations to industrial advancement. This system, however, is not capitalism, but rather an economic order that harks back to Otto von Bismarck in the late 19th century and Benito Mussolini in the 20th: corporatism.

In various ways, corporatism chokes off the dynamism that makes for engaging work, faster economic growth, greater opportunities and inclusiveness. It maintains lethargic, wasteful, unproductive and well-connected firms at the expense of dynamic newcomers and outsiders and favors declared goals such as industrialization, economic development and national greatness over individuals' economic freedom and responsibility. Today, airlines, auto manufacturers, agricultural companies, media, investment banks, hedge funds and much more have been deemed too important to weather the free market on their own. These sectors receive a helping hand from governments in the name of the "public good."

The costs of corporatism are visible all around us: dysfunctional corporations that survive despite their gross inability to serve their customers; sclerotic economies with slow output growth, a dearth of engaging work and scant opportunities for young people; governments bankrupted by their efforts to palliate these problems; and increasing concentration of wealth in the hands of those connected enough to be on the right side of the corporatist deal.

This shift of power from owners and innovators to state officials is the antithesis of capitalism. Yet this system's apologists and beneficiaries have the temerity to turn the tables and blame all these failures on "reckless capitalism" and "lack of regulation," which, they argue, necessitates more oversight and regulation. In reality, it means more corporatism and state favoritism.

It seems unlikely that so disastrous a system is sustainable. The corporatist model makes no sense to younger generations who grew up using the Internet, the world's freest market for goods and ideas. The success and failure of firms on the Internet is the best advertisement for the free market: social networking websites, for example, rise and fall almost instantaneously, depending on how well they serve their customers.

Sites such as Friendster and MySpace sought extra profit by compromising the privacy of their users and were instantly punished as users deserted them to relatively safer competitors like Facebook and Twitter. There was no need for government regulation to bring about this transition. In fact, had modern corporatist states attempted to do so, today they would be propping up MySpace with taxpayer dollars and campaigning on a promise to "reform" its privacy features.

The Internet, as a largely free marketplace for ideas, has not been kind to corporatism. People who grew up with its decentralization and free competition of ideas must find alien the idea of state support for large firms and industries. Many in the traditional media repeat the old line "What's good for Firm X is good for the United States," but it is not likely to be seen trending on Twitter.

The legitimacy of corporatism is eroding along with the fiscal health of governments that have relied on it. If politicians cannot repeal corporatism, it will bury itself in debt and default, and a capitalist system could reemerge from the discredited corporatist rubble.

If this ever happens, capitalism would again carry its true meaning, rather than the one attributed to it by corporatists seeking to hide behind it and socialists wanting to vilify it.

Saifedean Ammous is a professor of economics at the Lebanese American University. Edmund Phelps, the 2006 Nobel laureate in economics, is director of the Center for Capitalism and Society at Columbia University. © Project Syndicate

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.