Bourses greeted the beginning of the new month with a rapid crash of up to 4 percent on familiar fears of a Greek default and a slowing global economy.

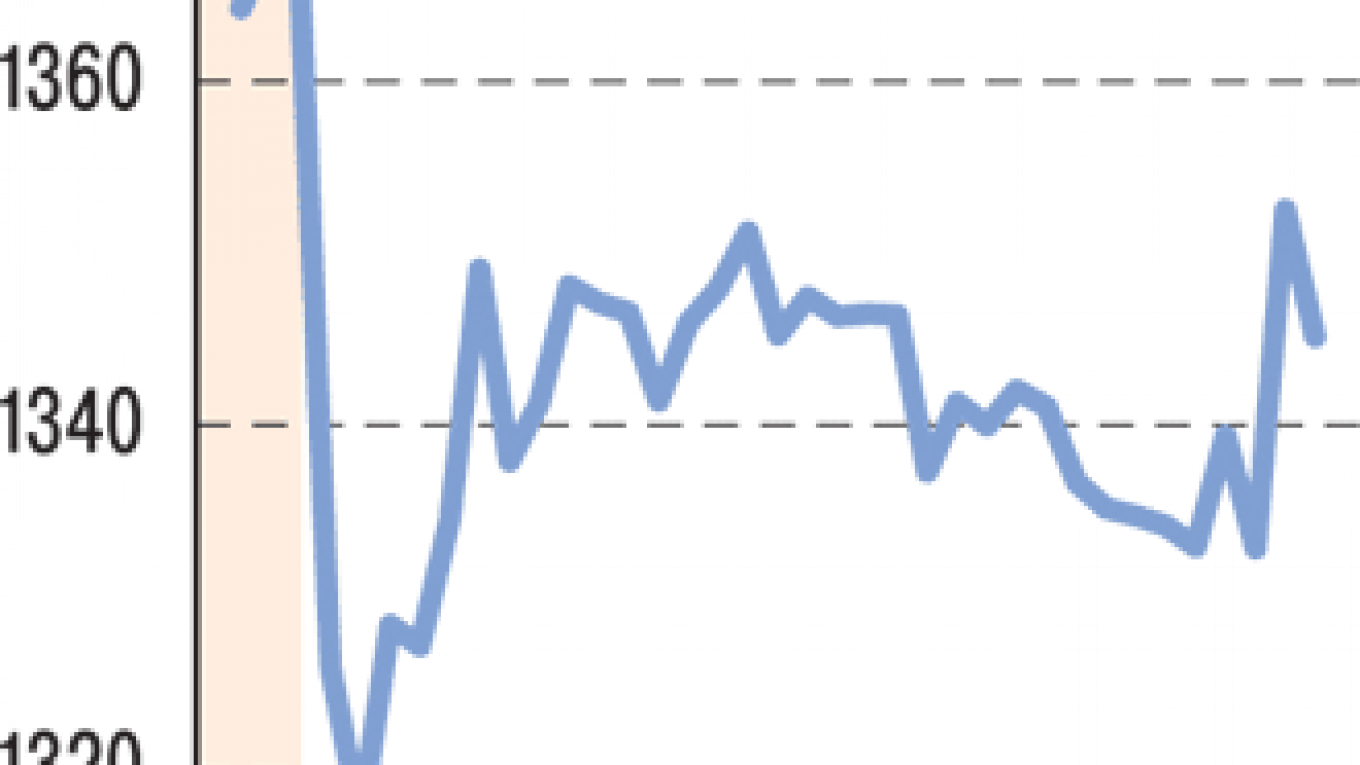

Though it pared losses late Monday, the MICEX Index was down 3.38 percent 20 minutes after opening. The dollar-denominated RTS had dived 3.89 percent by the same time.

The declines were in line with the downward trajectory of stocks globally. The Hang Seng in Hong Kong was down 4.38 percent Monday, and European markets opened sharply down, with Germany's DAX index initially falling 3.5 percent.

Sharp slides on opening came on the back of heavy falls Friday for Russian markets, which wiped out the tentative gains of last week. MICEX has now lost 20 percent of its value since the start of the year, and RTS 25 percent.

The third quarter was the worst quarter for Russian equities since the last quarter of 2008, when the world was in the throes of economic crisis.

Some losses were pared late Monday in volatile trading that followed positive manufacturing data from the United States, and MICEX closed down 1.6 percent at 1,344.66. The RTS finished 3.68 percent down at 1291.70.

Against a background of a sliding oil price, the ruble weakened, closing at 32.60 rubles against the dollar and 43.30 against the euro in the first day of October trading.

Chris Weafer, chief strategist at Troika Dialog, warned in a note Sunday that the markets were being stalked by the twin devils of a Greek default and a global recession.

The gloomy mood in Russia was reinforced by a report released by HSBC on Monday that showed Russian manufacturing had stalled badly in the third quarter — a sharp reversal of positive growth in the first. Russia Manufacturing PMI, an index that tracks overall business conditions, was at its lowest since the fourth quarter of 2009, the report said.

HSBC chief Russian economist Alexander Morozov said the Russian economy was facing lasting stagnation.

In yet another parallel with 2008, official figures revealed Monday that Russian banks had borrowed $16 billion from the Central Bank in September — the highest figure since October 2008, the month after Lehman Brothers collapsed prompting the global liquidity crisis.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.