A biannual report compiled by the London-based think tank Z/Yen and released Monday suggests that no one should be holding their breath over Moscow's transformation into an international financial center.

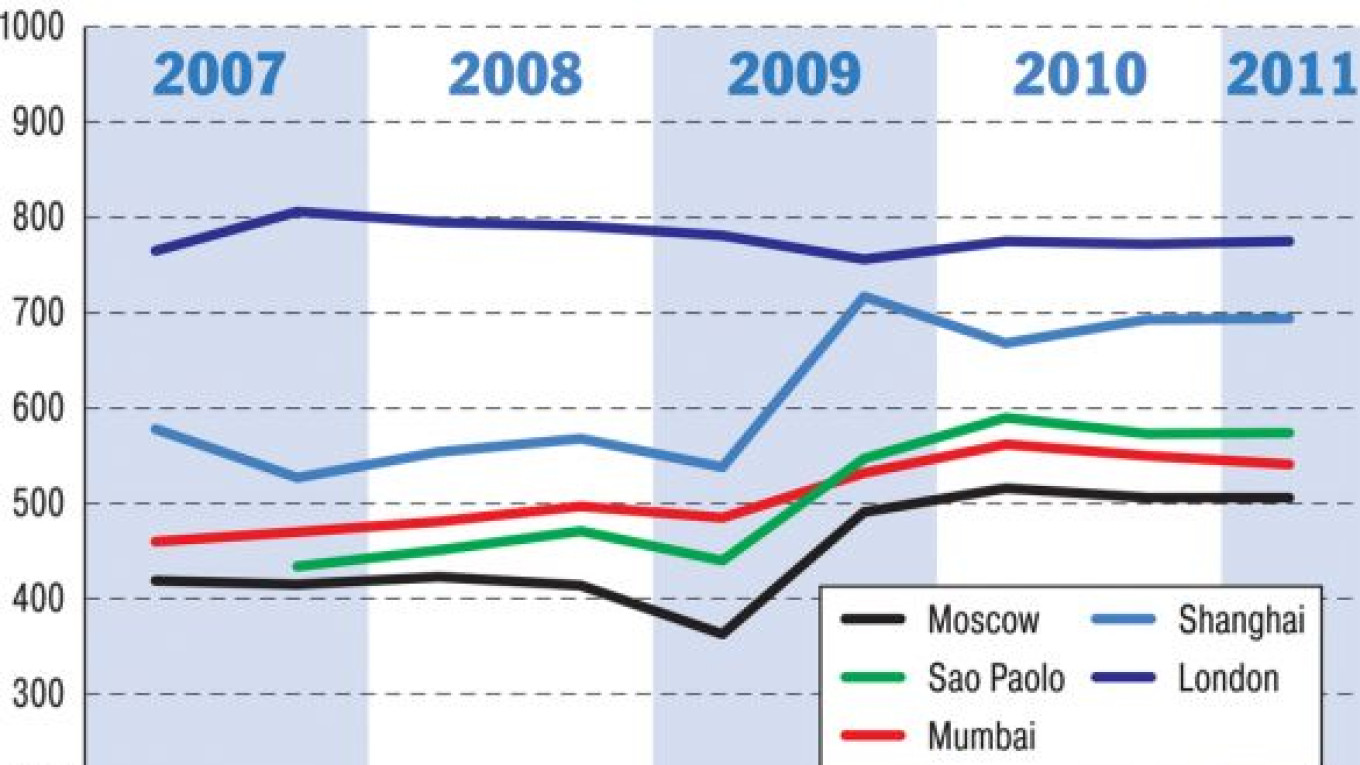

Moscow ranked 68th out of 75 in the Global Financial Centers Index and did not feature in the 10 centers likely to be most significant in the coming years.

As well as acknowledged financial powerhouses like London, Hong Kong, Tokyo and Geneva, Moscow was behind other cities such as Warsaw, Copenhagen and Manila. It even ranked below debt-ravaged Dublin and Lisbon.

Neither was Moscow a clear leader in Russia itself. Since the last report in September 2010, St. Petersburg had climbed two places and 13 rating points, coming in at 69th place and snapping at Moscow's heels.

Mark Yeandle, the report's author and a member of a Moscow-based working group advising on the changes needed in city's infrastructure, said, however, that it was "early days" for Moscow.

"In the next couple of years," he said, "the future is bright."

He added that Moscow's lack of progress should be seen in the context of "a remaining feeling of uncertainty in the market."

The report was put together using a variety of external indices — from property surveys to measurements of corruption perception ?€” as well as the responses to an online survey that asked respondents to assess competitiveness.

President Dmitry Medvedev has expressed consistently strong support for Moscow's aspirations in the field of international finance.

On March 4, he said "the creation of a financial center remains one of the unconditional priorities of the development of the state," and named Moscow's financial architecture and the city's infrastructure as the two major challenges needing to be addressed.

In line with Monday's report, some commentators are not upbeat about Moscow's prospects.

Speaking at an investment conference two weeks ago, Richard Sobel, chief executive at Alfa Capital Partners, said that, despite a global explosion over the last 10 years, "Russia's share of the private equity market has been falling behind."

"You can't have a leading financial center without equity capital," he added.

Jacob Grapengiesser, a partner at the asset management company Eastern Capital, told The Moscow Times on Monday that a key problem was legislation that prohibits publicly traded Russian issuers from trading more than 25 percent of their shares in American Depositary Receipts.

This cap pushes Russian companies to redomicile abroad and list their shares in London or New York via holding companies.

"This creates a lot of headaches," Grapengiesser said.

He acknowledged that there was a high level of political activity directed at changing Moscow's financial environment.

"However," he added, "it remains to be seen whether this can make its way into legislation."

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.