The Kremlin rarely approaches EU-Russia summits with much enthusiasm, but there are signs that this may change in anticipation of the next summit in Rostov-on-Don on May 31. Although this newfound willingness is far from voluntary — caused by a sharp shock provided by the global economic crisis — it is something we should welcome and build upon.

At November’s summit in Stockholm, the European Union and Russia discussed three key areas: trade relations, climate change and energy security.

Russia has in recent weeks confirmed its intention to abandon the customs union with Kazakhstan and Belarus — a factor that delayed Russia’s entry into the World Trade Organization — and again? pursue solo membership.? On climate change, President Dmitry Medvedev said he would be willing to cut carbon emissions by 10 percent to 15 percent of 1990 levels.? On energy security, the parties signed a memorandum requiring each to notify the other of any likely disruption to energy supplies and to work together to resolve the problem.

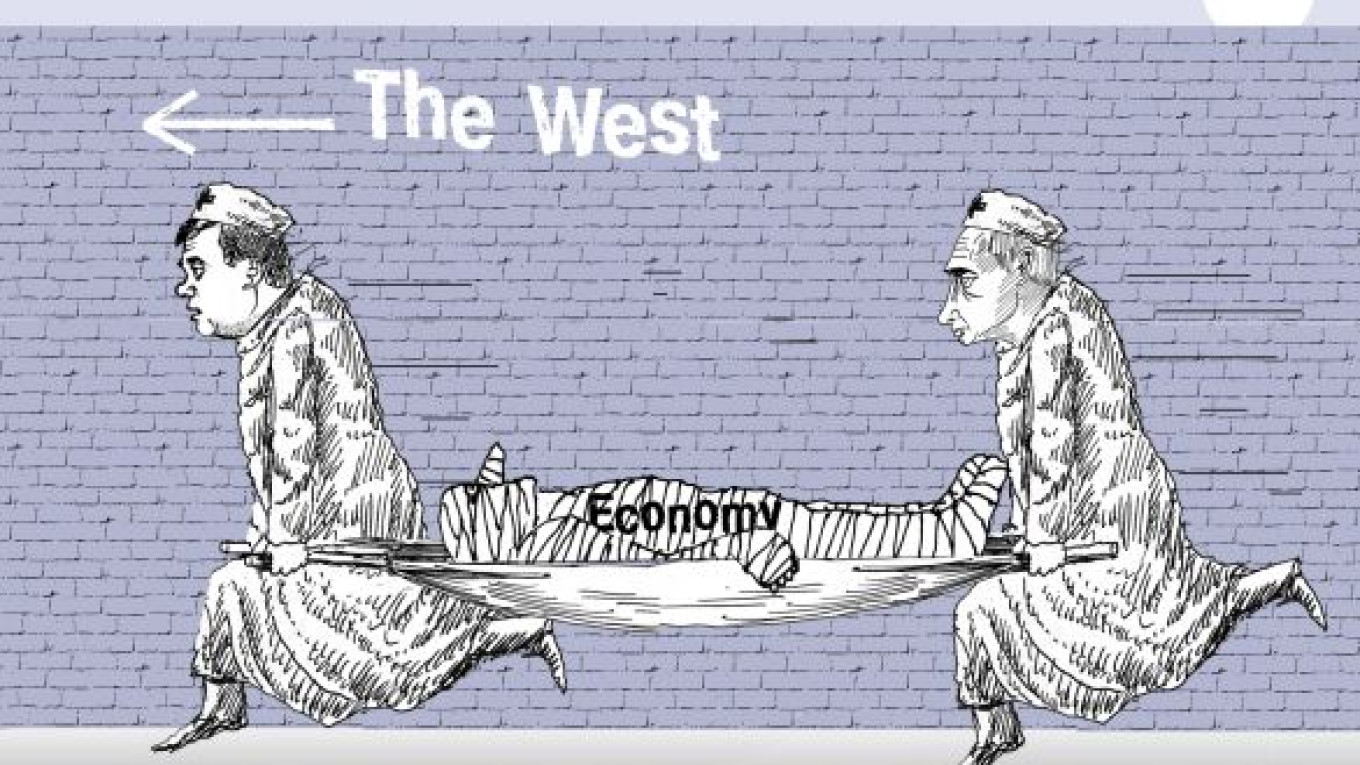

Russia’s desire to maintain a position on the world stage has undoubtedly played a part in its uncharacteristically cooperative mood of late, but the key driving factor is its troubled economy.

Dominated by oil and gas, the economy needs significant foreign investment and expertise to develop new and existing fields to meet projected energy demand. The International Energy Agency estimates that cumulative global investment of more than $5.1 trillion will be required to meet gas market trends to 2030.

But Russia’s formal withdrawal from its application to the Energy Charter Treaty in October has done nothing to encourage that investment. In fact, it has left future investors in the energy sector with no protection for their investments.? The treaty, signed by Russia in 1994, was expressly designed to encourage the investment now required by providing enforceable legal protection against expropriation and discriminatory treatment.

In April, First Deputy Prime Minister Igor Shuvalov said Russian WTO membership would “give foreign investors the reassurance that they can seek remedy in a court of law if they are not treated fairly.”

Russia’s WTO entry is long overdue and must be given serious consideration during this EU-Russia summit, not least because it will provide a legal framework for state-to-state trade relations with Russia. But it will not offer direct protection to foreign investors seeking relief, as Shuvalov suggests, and they will still need to rely solely on the highly politicized Russian courts.

Russia desperately needs a legal framework? ? on which foreign investors in the country can rely. They must know that their interests are protected and that their rights will be upheld by an independent judiciary.

The fact that Russia was bound by the Energy Charter Treaty was confirmed by an international tribunal in November, which heard compensation claims against Russia brought by the majority shareholders of the now-nonexistent Yukos Oil. This ruling clears the way for the former shareholders to pursue their multibillion-dollar compensation claim.

Russia’s withdrawal from the Energy Charter Treaty in October means that new investors must rely on the Russian courts or bilateral investment treaties, where they exist. These treaties vary greatly in the protection offered to investors. Investments existing in October remain protected by the Energy Charter Treaty for another 20 years.

What is at stake in this case is far more important than the compensation to which Yukos’ former majority shareholders may be entitled. What is at stake is the rule of law in Russia. The Yukos affair was and remains characterized by an almost total breakdown in legal process and judicial independence.

Yukos was expropriated through discriminatory and bogus back tax claims, and its assets were frozen to prevent Yukos from even attempting to settle the bogus claims against it or to continue operating.? The company was artificially forced into bankruptcy, and its assets were sold at a series of sham auctions. There was so little due process in the whole affair that Dutch courts in 2007 refused to recognize the authority of the Russian-court appointed receiver.

The only way that Russia can encourage new investors to bring desperately needed expertise and investment to its energy sector is if the country agrees to a strong, legally binding and independently enforceable agreement to succeed the Energy Charter Treaty. Only through such an agreement can the EU secure true reciprocity of investment with Russia.

Accepting and adhering to the terms of the WTO would be a strong start. The finalization of a successor partnership and cooperation agreement between the EU and Russia, including the legally binding dispute resolution principles enshrined in the Energy Charter Treaty, would be a further significant step.

At a time when Russia is again in dire need of investment to modernize its energy infrastructure and to deliver on current and future supply commitments, Europe and Russia must make sure that further progress is made toward this end.

Tim Osborne is a director of GML Limited.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.