Despite the tripling of profits announced by Sberbank on Tuesday, sharp falls in the share price of the country's biggest lender have prompted analysts to raise concerns about the viability of the bank's flagship privatization plans.

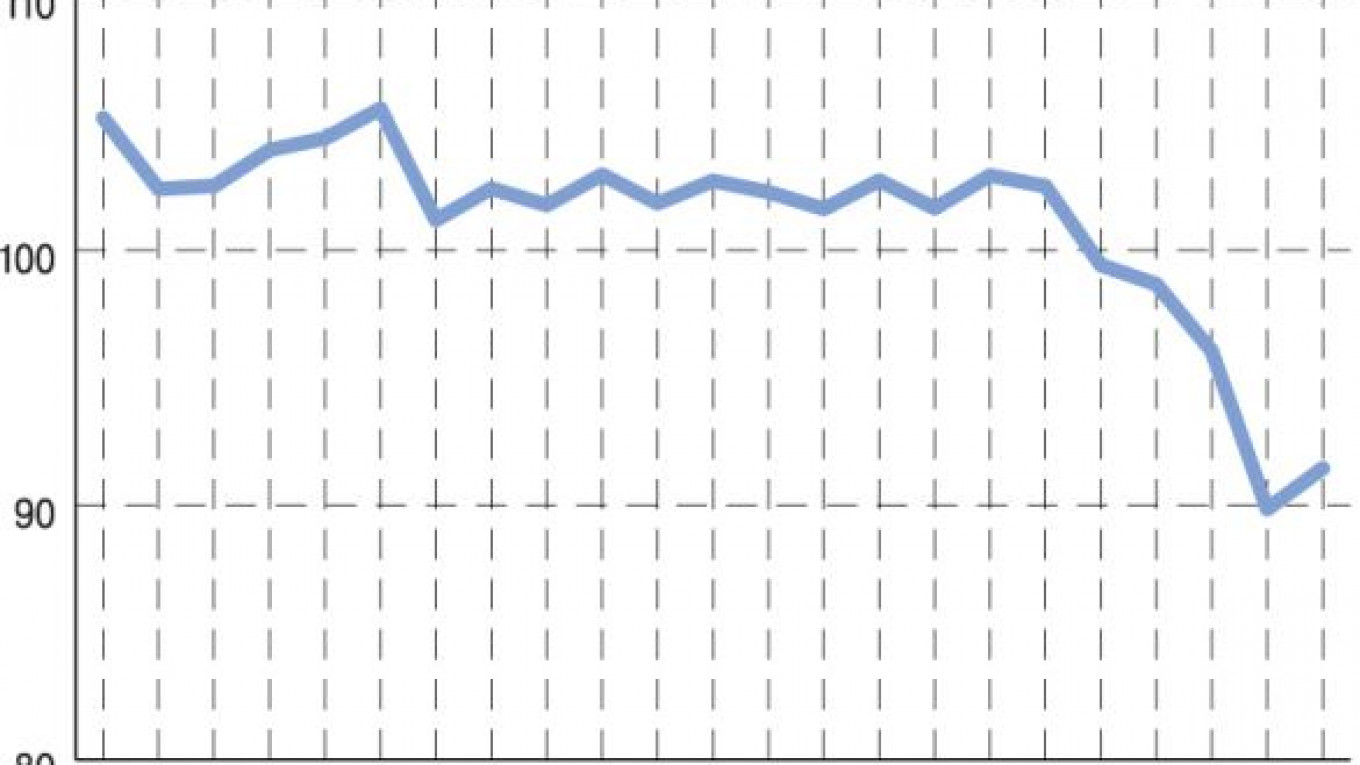

Amid market turmoil Sberbank was down 17.8 percent at one point on Monday from a July 7 high of 107.63 rubles. In line with a market rally, the company closed up two percent Tuesday at 91.6 rubles.

President German Gref said he was increasing his personal shareholding in the bank by 31 percent this week, and the bank posted profit of 201.2 billion rubles ($6.89 billion) for the first seven months of 2011, a threefold increase on the same period a year earlier.

But analysts said banks were particularly vulnerable during a market slump — and emerging markets have suffered intensively in recent days as investors fled to the perceived safety of developed economies.

"People shoot first and ask questions later — and they sell anything perceived as high risk," said Bruce Bower, a partner at Verno Capital.

Although Sberbank has suffered no more than other domestic financial institutions as the markets entered a tailspin last week, the declines have more significance because of its upcoming privatization. A 7.58 percent stake belonging to the Central Bank, valued at about $5 billion, is expected to be sold in the fall.

"If the market situation doesn't improve, the probability that they delay the privatization increases substantially — Sberbank is the crown jewel of the banking sector, and Russia is not going to want to sell it cheaply," said Jason Hurwitz, senior financial analyst at Alfa Bank.

"A couple weeks ago, I would have put the probability that the privatization was done by October at about 95 percent — now, it's more like 50 percent."

VTB Capital cautioned in a note that privatization could be pushed back into the fourth quarter, or even into 2012 — a delay that could "cannibalize the market's ability to absorb other privatization deals planned for next year."

Sberbank declined to comment on the possibility of a postponement if current market declines continue.

"The Central Bank has announced its intentions publicly to sell a part of its Sberbank share package. Any decision about the conclusion of that deal, whether it will be completed and in what time frame, will be taken by the Central Bank," the lender said in e-mailed comments.

Experts contacted by The Moscow Times said a cancellation of the privatization was highly unlikely, particularly in the event of a downturn creating gaps in the federal budget, but suggested that even a delay could be damaging.

"The state has a big interest in doing the privatization according to the timeline," said Bob Kommers, a financial analyst at Deutsche Bank. "It's not just a matter of price, but of prestige."

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.