Since the announcement of the share transaction between BP and Rosneft last week, there has been a lot of hype that BP’s investment somehow “legitimizes” the Rosneft takeover of most of Yukos’ assets as part of the Russian government’s expropriation of what was once the country’s largest private oil company. This is an absolutely ridiculous position taken by the media and commentators.

For years, Yukos was run like any other major Western oil company, with transparent financial reporting, investor relations and corporate governance all in place. But this ended with a bogus forced bankruptcy in 2006, which followed a two-year Russian government campaign of harassment using illegal tax claims and asset freezes and the illegitimate auction in 2004 of the company’s primary asset, Yuganskneftegaz, to the previously unknown Baikal Finance Group, which state-owned Rosneft acquired just two days later. The whole transaction using Baikal Finance Group and Rosneft was sanctioned by then-President Vladimir Putin but remained questionable legally under Russian law because it used financing from a state-owned bank.

Rosneft was directly involved in the bogus bankruptcy of Yukos. In December 2005, Rosneft struck a deal with Yukos’ primary group of lending banks. If the banks forced Yukos into bankruptcy, Rosneft would then buy all the loans that the banks had outstanding to Yukos. The loans were duly purchased by Rosneft within a couple of days after the banks forced the bankruptcy.

After Yuganskneftegaz was expropriated by the government, Rosneft decided to raise capital with an initial public offering on the London Stock Exchange in 2006. Rosneft’s IPO was strongly challenged by Yukos. We argued that since 75 percent of the Rosneft offering to potential investors was stolen assets, the offering was unsafe and in breach of international financial standards.

At the time, BP was coerced by Russia into purchasing Rosneft shares in the IPO, probably as a way for BP to protect its large investments in TNK-BP. The Rosneft IPO would have been a failure without Russia coercing BP and other companies that either wanted to protect existing assets or gain favorable terms in purchasing new assets.

At that time, no one talked about “legitimization,” so why is it any different today? Today, BP is again investing in a company whose largest assets were stolen by the Russian government. Would BP and its directors be just as happy to invest in a company whose primary assets were stolen works of highly prized art? The media and commentators would hardly be claiming that such an investment “legitimized” the theft of the treasured art.

The Yuganskneftegaz cycle was repeated in 2006 when the Russian court-appointed administrator auctioned 19 lots of Yukos assets in Russia. Rosneft benefited disproportionately from these illegal auctions and won over 75 percent of the lots. Former Yukos assets now make up about three-quarters of Rosneft’s asset value.

Based on the strong evidence presented in the European Court of Human Rights, we are confident that the Russian government will be found guilty of the illegal expropriation of Yukos assets. The damage claim on behalf of Yukos stakeholders amounts to more than $100 billion. After the court decides this case, the role that Rosneft and its chairman, Igor Sechin, played in the expropriation will be visible to everyone. An ethically questionable transaction on BP’s part is therefore far from a “legitimization” of the crimes committed by the Russian government and Rosneft, but rather a desperate move by BP to access high-risk exploration prospects. Putin’s “blessing” of the transaction is outrageous and constitutes a gross abuse of power. Putin also “blessed” the acquisition of the Sibneft oil company by Yukos and then facilitated the dismantlement of the completed acquisition through fraudulent Russian court decisions.

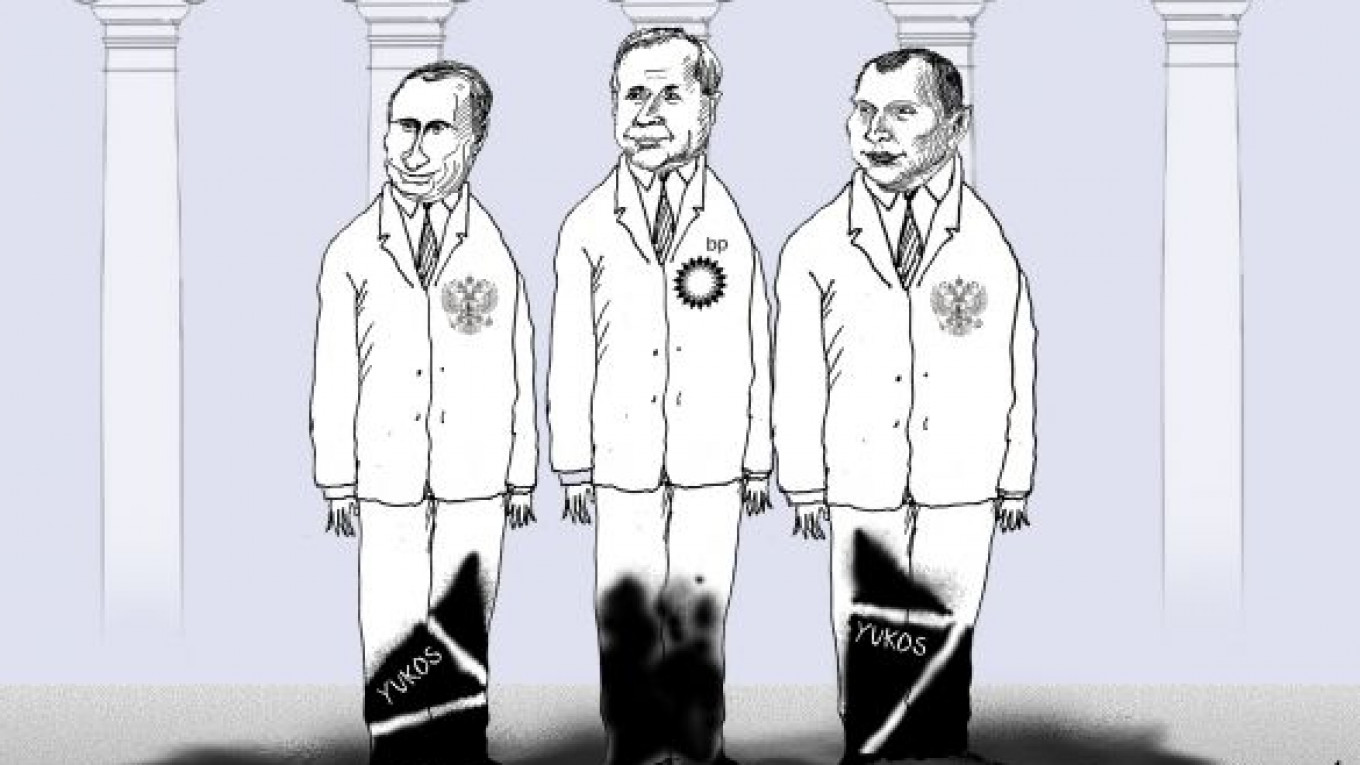

Photographs of BP’s new CEO, Robert Dudley, smiling next to Putin and Sechin at Putin’s Novo-Ogaryovo residence Friday were shown in newspapers all over the world. But just two years ago, in 2008, BP’s Moscow offices were being raided by gun-wielding police in what was thought to be an attempt to make BP discard its Russian joint venture. Then, Dudley wasn’t smiling. He was forced to flee the country after being questioned by police over alleged tax fraud. It appears that Dudley has a very short memory.

Since the deal was announced, BP and Rosneft have both emphasized that it gives them the unique opportunity to jointly explore for offshore oil and gas, particularly in the Arctic, that was previously reserved for Russian oil companies only. Dudley said it sends a “strong signal about the possibilities of investment cooperation in Russia.”

Meanwhile, BP Russia’s president Jeremy Huck said on Ekho Moskvy: “The projects we’re planning with Rosneft are sanctioned by the Russian government. The question about where those assets are from, that’s better asked of Rosneft or the government.” That’s called burying one’s corporate head and corporate ethics in the sand.

Some say Rosneft’s actions are likely to scare off Western investors, depriving Russia of Western investment capital that it desperately needs. Shareholders and investors have no guarantee of the security of Rosneft’s ethics and ownership. Yukos has more than 55,000 shareholders, more than 50,000 of whom are Russian. They are still waiting for answers.

The truth has not changed one iota after BP’s investment in Rosneft. BP is calling its own business ethics into question. How will the international finance community now start treating BP once it has become clear that BP is participating in a form of money laundering of Rosneft’s stolen assets? Many BP shareholders have already answered this question, showing their understandble concern about Rosneft’s reputation and the fact that BP sold itself out in terms of the company’s reputation and its stated commitment to corporate governance and transparency.

Bruce Misamore is former chief financial officer of Yukos.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.