Nearly every evening after Gennady Zimin, a 24-year-old lawyer, returns to his Moscow apartment from work, he spends a few minutes at his virtual farm on Vkontakte, the leading social networking web site.

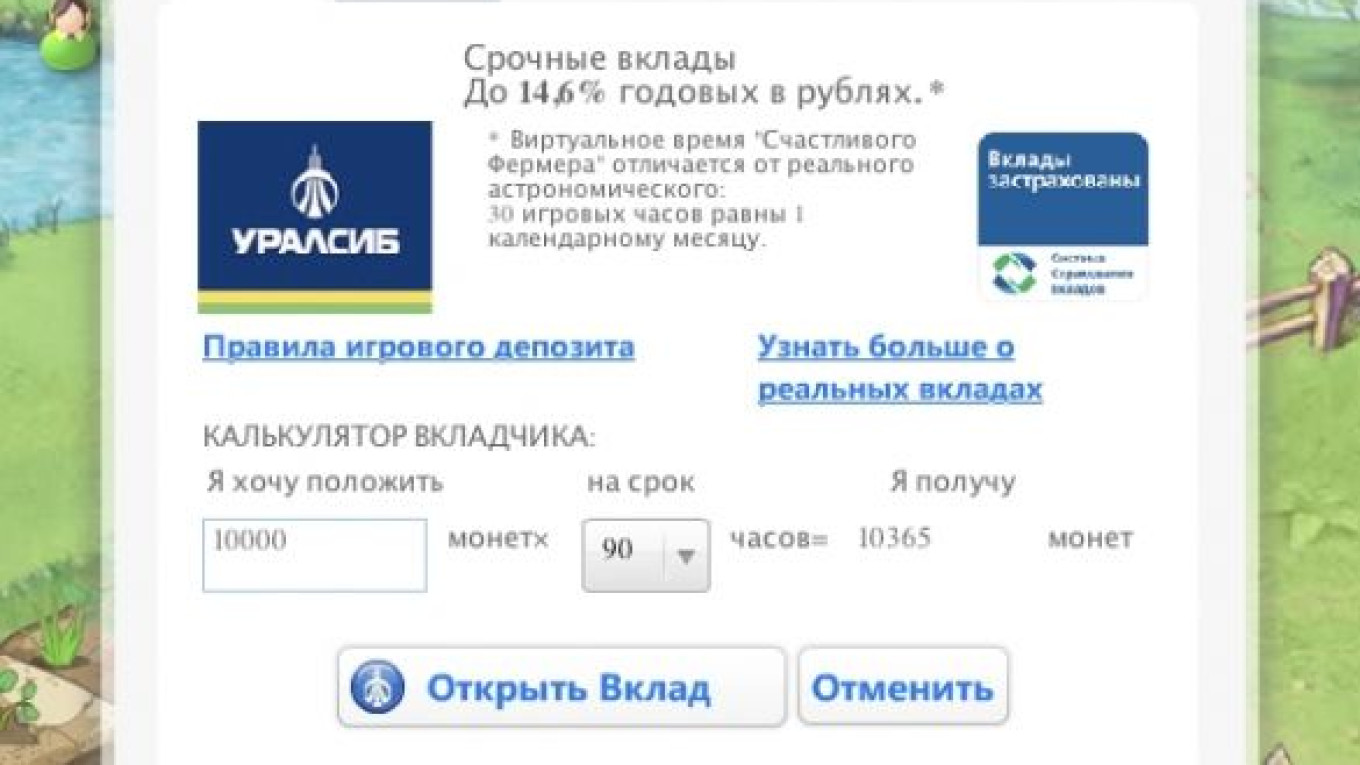

Zimin plants carrots and potatoes and tends pigs on “The Happy Farmer,” one of Vkontakte’s most popular social applications launched in April. When he wants to take out a loan to improve his farm or to deposit money earned by selling vegetables, he clicks on a menu icon with the logo of UralSib, an investment and retail bank.

The television advertising market faces a shakeup after the Federal Anti-Monopoly Service opened an investigation into Video International this month.

Video International, the leading seller of television commercials, has been accused of violating the law on competition by its main rival, Gazprom-Media.

United Russia deputies sent a bill to the State Duma on Monday that would limit the market share of television commercial sellers to 35 percent, Kommersant reported Tuesday.

Video International, which sells advertisements on 12 terrestrial channels, including Channel One, Rossia and CTC, has a 60 percent market share, while Gazprom-Media and Alkasar together control more than 30 percent.

The proposed legislation forbids national television channels from signing agreements with sellers whose market share exceeded 35 percent. It also proposes that auctions or competitive tenders be held to choose contractors for national television channels.

— MT

UralSib’s appearance on Vkontakte’s free application is part of a larger shift during the economic crisis that has led companies to unexpectedly funnel a bigger portion of their advertising budgets to television and the Internet, even as they slash spending on newspapers, magazines and billboards.

The logic is simple: Consumers have less money to spend, so they are spending more time in front of their television sets and computer monitors at home.

“People have stopped going to movie theaters and entertainment centers and even visiting friends. They are trying to cut the amount of money spent on cell phones … and they have stopped reading newspapers and magazines, which they have to buy,” said Dmitry Orchenko, business development director at Aegis Media, an international media and market research group. “At the same time, people are watching more TV … and spending most of their time on the Internet.”

Television ad sales represent the biggest surprise, with the share of companies’ advertising budgets earmarked for the commercials rising to 56 percent in the first nine months of this year, the most recent figures available, from 51 percent in the same period last year, said Video International, the leading seller of ads on Russian television.

The switch is sharp and unexpected, fueled by crisis-hit companies’ need to redistribute their ad spending to maximize results, said Sergei Veselov, the marketing research director with Video International Analytical Center.

“We expected the share of ad budgets spent on TV commercials to reach 55 to 56 percent over the next four to five years, but the crisis seems to have catalyzed the process,” Veselov told The Moscow Times.

Procter & Gamble, ranked by TNS Russia as the top television advertiser for the past five years, confirmed that it had increased the share of its budget earmarked for television.

“The television share of our ad budget has really increased,” company spokeswoman Yulia Mayorova said. “We redistributed our advertising funds because we had to optimize our investments due to the crisis.”

She and officials at other companies interviewed for this article were tight-lipped about specific ad figures.

Mayorova said, however, that Procter & Gamble, like many companies, had trimmed its ad budget this year and focused more on television commercials as a way to increase exposure for its household goods like Tide laundry detergent, Head & Shoulders shampoo and Gillette razors.

“The efficiency of television is much higher than that of the print media,” Mayorova said. “We’re basing this on the number of people who will see our advertisements. Millions will see them on TV.”

Wimm-Bill-Dann, the maker of Domik v Derevne dairy products and J7 fruit juices, has increased television spending, and commercials now account for 95 percent of all its advertising, spokeswoman Marina Kagan said, without providing comparative figures.

“We have benefited from the crisis. While many companies were cutting their advertising expenditures and volumes of advertisements, we managed to differentiate ourselves from others,” she said.

Veselov, of Video International, said big advertisers were benefiting at the detriment of smaller ones. “Small advertisers had to wind down their campaigns on TV because of the crisis. This allowed the major ones to increase their share on television,” he said.

As a result of the increased focus on television, ad sales there have outperformed the ad market as a whole. The volume of television ads contracted by 21 percent over the first nine months of this year after amounting to 94.5 billion rubles ($3.14 billion) in the same period last year, according to AKAR, an industry association. In comparison, the overall ad market shrank by 30 percent from January to September, it said.

Veselov said overall ad figures appeared to be improving and might show a decline of less than 30 percent for the year, while television ad sales this month looked likely to match or top December 2008 figures. Cable television ads, meanwhile, are expected to reach 1.5 billion rubles this year, up from 1.3 billion rubles in 2008, he said.

The shift in advertising is being driven by a substantial drop in consumer spending and subsequent changes in consumer behavior, said Oksana Povarishnikova, a customer director at Synovate Russia, a market research company. She said 51 percent of Russians had cut their spending as of September.

“The crisis has taught Russian consumers to be more rational. People have started to plan their purchases and are now going to a grocery store with a shopping list,” Povarishnikova said.

People like Gennady Zimin, the lawyer who plays “The Happy Farmer” on the Internet after work, are preferring to spend time at home watching television and surfing the Internet.

“I’ve been using ‘The Happy Farmer’ for three months,” Zimin said in an interview. “It helps me relax after a working day when I have nothing to do. There’s a cow, a pig and even a donkey on my farm.”

Asked whether he feels any loyalty toward UralSib for handling his virtual financial needs, Zimin gave an emphatic “no.”

“The UralSib ad doesn’t affect me because I prefer not to take loans at all,” he said.

But Internet advertisers like UralSib hope that Zimin is in the minority.

UralSib declined to say how much money was invested into “The Happy Farmer” but Maxim Savitsky, head of its marketing department, said the bank was pleased with the exposure offered by the application. He said the UralSib icon has received more than 540 million views since the promotion started two months ago.

“It’s a promotional project that allows us to integrate ourselves deeply into the game process,” Savitsky said. “Our task is not only to advertise, but also to attract young users who are potential consumers of banking services.”

Free applications like “The Happy Farmer” can be used as new advertising platforms, but it remains unclear how to use them effectively, said Andrei Chernyshov, CEO of AdWatch/Isobar Russia.

More traditional forms of Internet advertising are fueling growth in sales this year, with total ad volumes excluding contextual ads climbing by 3 percent from January to September, AKAR said.

But some industry players expect Russian Internet ad revenues to remain flat this year.

Alexei Katkov, commercial director for Mail.ru, Russia’s most popular web site, said earlier this year that he expected year-end ad revenues to reach 1.2 billion rubles, the same amount as last year.

Vkontakte, which has more than 50 million registered users, and other social networks are considered to be among the most attractive web sites for advertisements.

“Advertisers are very much interested in placing banners on Vkontakte.ru because it gives them limitless possibilities,” said Maria Smirnova, head of Media Plus, which sells advertising space for Vkontakte.

Among the major companies that place advertisements on Vkontakte are Google, Mobile TeleSystems, Nokia, Intel, Oriflame, Nissan and Alfa Bank.

Russians spend an average of 13 to 14 minutes on social networks per day, Vedomosti reported, citing research by ComScore.

Video International said Internet users represent a promising audience for advertisers but limitations such as a lack of Internet access in many Russian regions prohibited growth. It also noted that the Internet does not offer an ad monitoring system like television or print media, and some products don’t sell well online, such as fast-moving consumer goods like food and household items.

With the crisis still hitting consumers hard, few industry insiders want to venture a guess on ad sales for the Internet and television next year.

“The advertising market is based on the consumer market, but no one has an unambiguous understanding of how the country’s consumer market will develop in the nearest future,” said Veselov, of Video International. “Therefore, it would not be right to discuss an exact forecast for the advertising market.”

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.