Russia's Novgorod region defaulted on its debt in February, according to news agency RBC, heightening fears of a wave of defaults by heavily indebted regional governments across the country.

Russia's regions borrowed heavily in recent years to fund extravagant spending promises by President Vladimir Putin. But with a shrinking economy now squeezing tax revenues, analysts have warned that the more than 2 trillion rubles ($37 billion) of debt already accumulated by regional governments is unsustainable.

According to RBC, Novgorod, in northwest Russia, became the first region to default this year when it missed a Feb. 25 repayment deadline on a loan of about 2 billion rubles ($37 million) from a state-controlled bank, VTB.

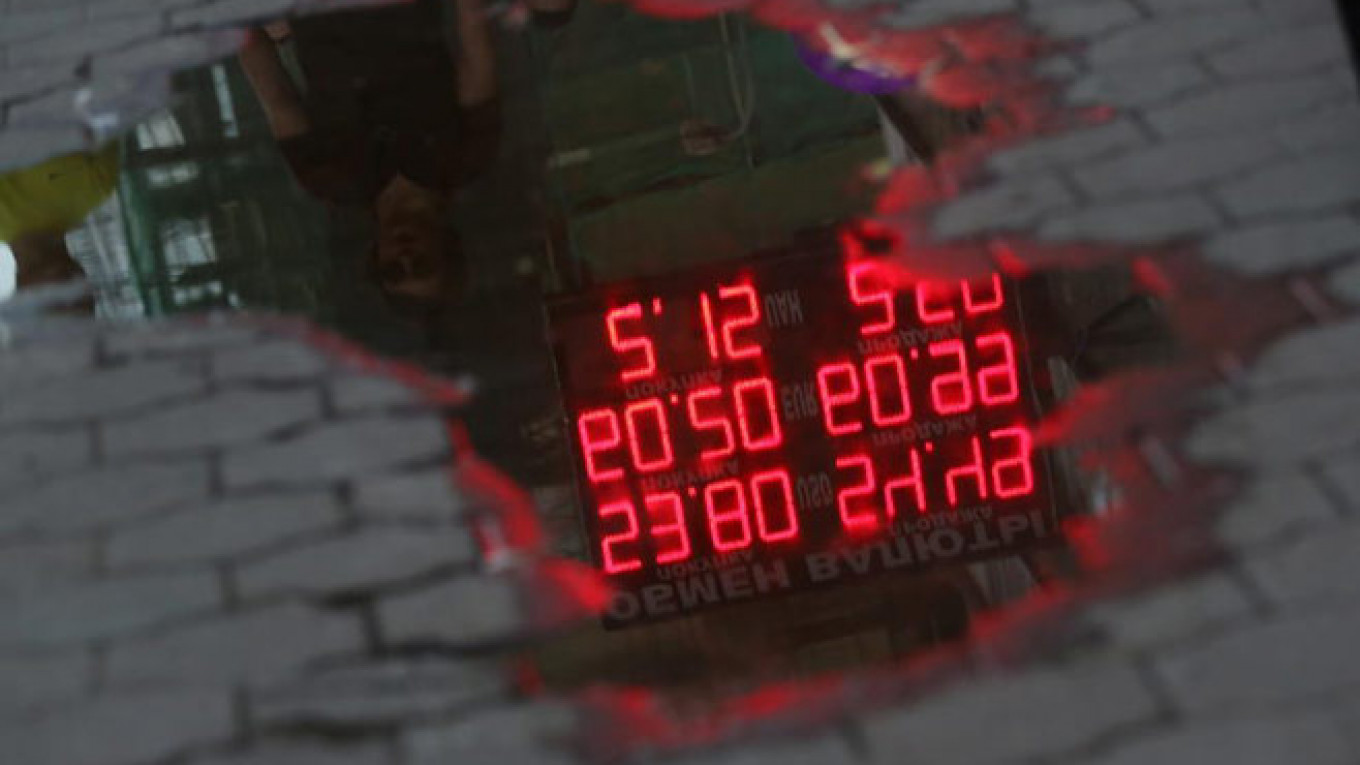

In a last-ditch effort to meet the deadline, the Novgorod government announced a credit auction at a 23.63 percent interest rate, but the move failed to raise the necessary cash, RBC said, citing an unidentified source inside Novgorod's finance department.

According to the source, the Novgorod regional government cut a deal with VTB following the missed payment to lower the interest rate on the loan and settled the debt soon afterward.

Novgorod, a relatively wealthy, tourism-focused region near St. Petersburg, had outstanding commercial loans worth 8.4 billion rubles ($155 million) as of May 1, making it the 34th-largest holder of such debt among Russia's regions, according to Finance Ministry data cited by RBC. Russia has 85 regions, including Crimea and Sevastopol, which Moscow annexed from Ukraine last year.

Novgorod may not be the only region to have defaulted in the first quarter.

Earlier this month, ratings agency Standard & Poor's said it had identified numerous cases in which regional governments facing default received loan extensions at below-market rates, which the agency said was tantamount to a default — usually defined as failure to pay interest or return a debt in full or on time.

S&P said that Russia's rising economic crisis, in combination with federal pressure to keep up social spending promised by Putin, would put a number of Russian regions at risk of default over the course of the year.

“Standard & Poor's believes that regional defaults in Russia are not only likely, but have already been taking place according to our definitions,” a press release by the agency said.

Russia's economy is expected to shrink by around 3 percent this year as Western sanctions imposed over the Ukraine crisis and the low price of oil, the country's main export, starve the country of funds.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.