Moscow’s bourses jumped in early trading Sunday morning as they caught up with the gains made on international markets during the holiday period.

The apparent success of debt restructuring in Greece and positive industrial data from the United States boosted European- and Asian-traded equities Thursday and Friday while Russians took a break for International Women’s Day celebrations.

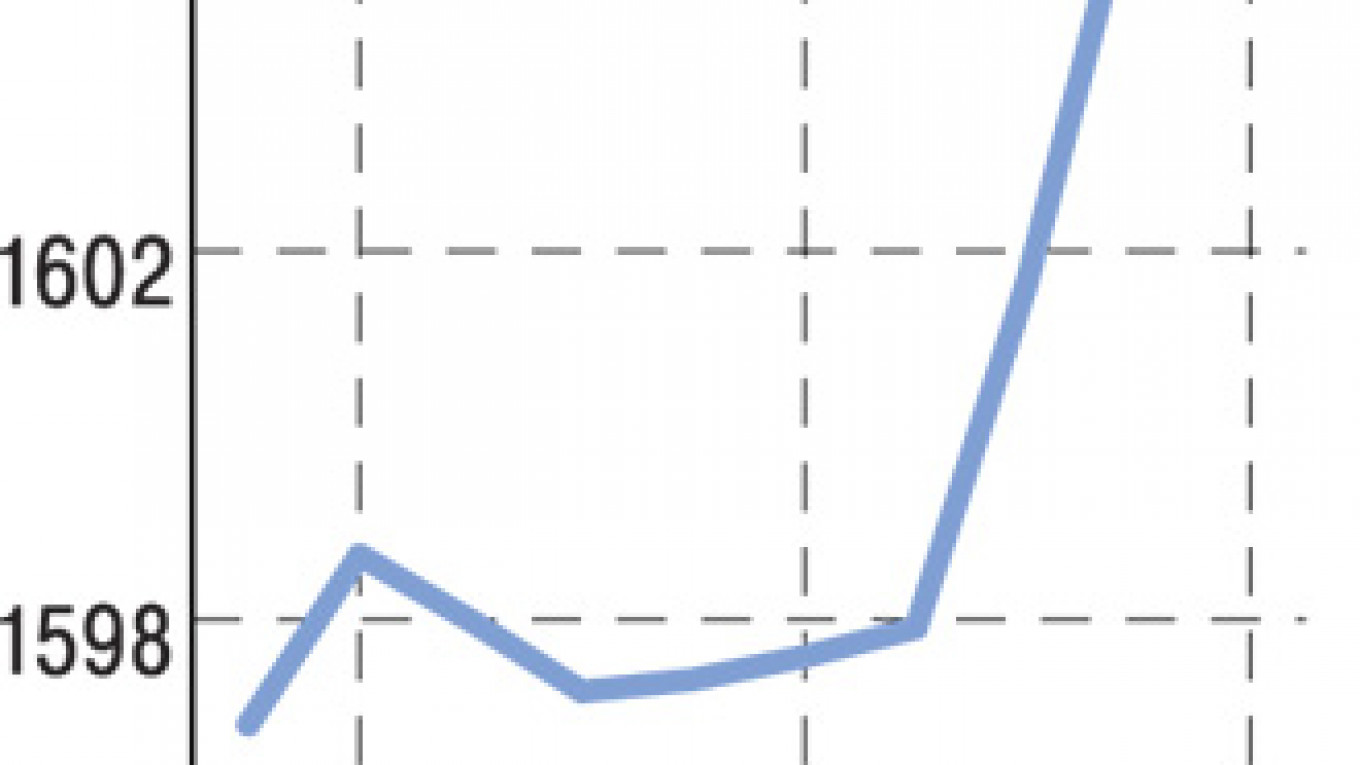

The MICEX Index broke through the 1,600 mark and closed up 2.13 percent at 1,606.33 Sunday, its biggest rise in two weeks. The dollar-

denominated RTS Index finished at 1,721.27, up 2.63 percent. After rapid gains on opening, a weak news flow meant stocks remained almost flat for the rest of the day before climbing slightly ahead at the 18:45 bell.

Global stocks rose Thursday and Friday. The Dow Jones Industrial Average was up 0.66 percent and London’s FTSE 100 rose 1.65 percent.

“Greece exchanged its [old] debt for new, which allowed global investors to end the week in an optimistic mood,” analysts at Nomos Bank wrote in a note Sunday. “Good labor data from the United States [also] encouraged market players.”

Urals crude, the benchmark for Russian oils, closed up slightly Friday to $123.74 a barrel.

Gains on Wednesday and Sunday mean that the indexes have almost pared last week’s fall in the wake of Prime Minister Vladimir Putin’s election win. The MICEX Index dropped 3.9 percent Tuesday after the forcible dispersal of protesters near the Kremlin and worrying economic data from China, coming off a seventh-month high recorded the day before.

Both Sunday’s bounce and last week’s losses were primarily linked to external factors, said Vladimir Tikhomirov, chief economist at Otkritie Capital. But he added that the low turnout at an opposition rally Saturday was “another reason for investors to be more positive about the ability of Russia to sustain political stability.”

“The situation is getting back to normal,” Tikhomirov said, referring to recent political events. “In terms of investor sentiment that’s definitely better because investors are very cautious when … there are mass demonstrations taking place.”

Market leaders for the MICEX Index on Sunday included oil pipeline monopolist Transneft that gained 6.2 percent and Surgutneftegaz that rose 4.8 percent. Gazprom was up 1.8 percent, VTB by 1.8 percent and Russia’s biggest lender, Sberbank, by 1.9 percent.

Analysts at InvestCafe said in a note Sunday that the presidential election had “introduced clarity” and that demonstrations had not had a significant impact on trading. “Therefore investors can be calm,” they wrote.

The ruble also gained. In currency trading on MICEX the dollar lost 17 kopeks and closed at 29.52 rubles. The euro also lost 17 kopeks, ending the day at 38.82 rubles.

InvestCafe said the high oil price and growth on global stock exchanges could simulate interest in riskier assets this week. They identified the ongoing debt restructuring in Greece as the factor that would weigh most on markets.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.